Are you a business owner or accountant looking for a convenient way to create and manage 1099-NEC forms? Look no further! In this article, we'll provide you with a comprehensive guide on how to easily download and use a 1099-NEC template in Word, as well as step-by-step instructions on how to fill it out.

What is a 1099-NEC Form?

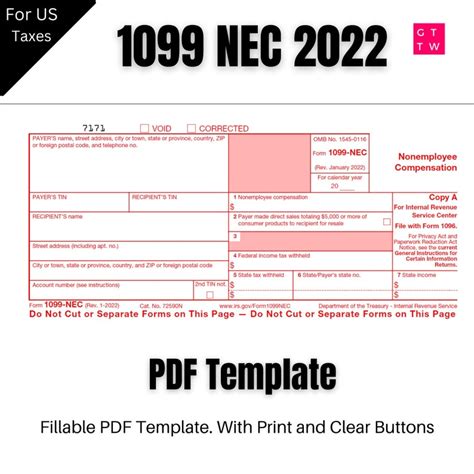

The 1099-NEC form, also known as the Non-Employee Compensation form, is used to report non-employee compensation paid to independent contractors, freelancers, and other non-employees. This form is typically used by businesses and organizations to report payments made to individuals who are not employees, such as contractors, consultants, and freelancers.

Why Do You Need a 1099-NEC Template?

Having a 1099-NEC template can save you time and effort when it comes to creating and managing these forms. A template can help you:

- Easily fill out the form with the required information

- Ensure accuracy and compliance with IRS regulations

- Save time and reduce errors

- Streamline your reporting process

Where to Download a 1099-NEC Template in Word

You can download a 1099-NEC template in Word from various online sources, including:

- The IRS website (irs.gov)

- Microsoft Word template gallery

- Online template websites, such as Template.net or Wordtemplates.net

Instructions for Filling Out a 1099-NEC Template in Word

Here's a step-by-step guide on how to fill out a 1099-NEC template in Word:

Section 1: Payer's Information

- Enter the payer's name, address, and taxpayer identification number (TIN)

- Make sure to include the correct business name and address

Section 2: Recipient's Information

- Enter the recipient's name, address, and TIN

- Make sure to include the correct recipient name and address

Section 3: Non-Employee Compensation

- Enter the total amount of non-employee compensation paid to the recipient

- Make sure to include the correct amount and date of payment

Section 4: Federal Income Tax Withheld

- Enter the total amount of federal income tax withheld from the non-employee compensation

- Make sure to include the correct amount and date of withholding

Section 5: State and Local Taxes

- Enter the total amount of state and local taxes withheld from the non-employee compensation

- Make sure to include the correct amount and date of withholding

Certification and Signature

- Sign and date the form to certify that the information is accurate and complete

Tips and Reminders

- Make sure to keep a copy of the completed form for your records

- File the form with the IRS by the required deadline

- Provide a copy of the form to the recipient by the required deadline

Gallery of 1099-NEC Templates

FAQs

What is the deadline for filing 1099-NEC forms?

+The deadline for filing 1099-NEC forms is January 31st of each year.

Who needs to file 1099-NEC forms?

+B businesses and organizations that paid non-employee compensation to independent contractors, freelancers, and other non-employees need to file 1099-NEC forms.

How do I obtain a 1099-NEC template?

+You can download a 1099-NEC template from the IRS website, Microsoft Word template gallery, or online template websites.

Conclusion

In conclusion, using a 1099-NEC template in Word can save you time and effort when it comes to creating and managing these forms. By following the step-by-step instructions and tips provided in this article, you can ensure accuracy and compliance with IRS regulations. Don't forget to keep a copy of the completed form for your records and file it with the IRS by the required deadline.