Understanding the financials of an apartment complex is crucial for real estate investors, developers, and property managers. A pro forma is a financial projection that helps you estimate the potential income and expenses of a property over a specific period. In this article, we will explore how to create an apartment pro forma Excel template and make it easy to use.

The Importance of Pro Forma Analysis in Apartment Investing

Pro forma analysis is essential in apartment investing as it helps you evaluate the potential financial performance of a property. By creating a pro forma, you can estimate the income and expenses of a property over a specific period, usually 5-10 years. This allows you to make informed decisions about investments, financing, and property management.

Key Components of an Apartment Pro Forma

A typical apartment pro forma includes the following key components:

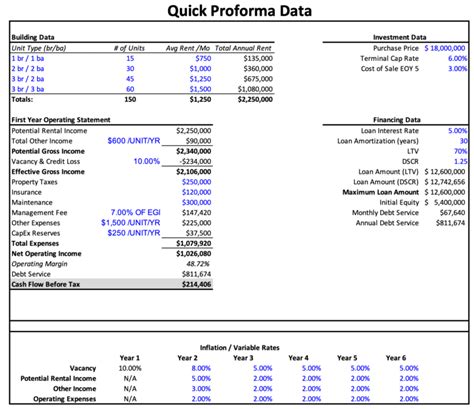

- Income: Estimated rental income, other income, and total income.

- Expenses: Operating expenses, including property taxes, insurance, maintenance, and management fees.

- Cash Flow: Net operating income (NOI), cash flow before taxes, and cash flow after taxes.

- Debt Service: Loan payments, including principal and interest.

- Return on Investment (ROI): Estimated return on investment, including cash-on-cash return and internal rate of return (IRR).

Creating an Apartment Pro Forma Excel Template

To create an apartment pro forma Excel template, follow these steps:

- Set up a new Excel spreadsheet and create separate sheets for income, expenses, cash flow, debt service, and ROI.

- Enter the property's financial data, including rental income, expenses, and debt service.

- Use formulas to calculate the key components of the pro forma, such as NOI, cash flow, and ROI.

- Use charts and graphs to visualize the data and make it easier to understand.

Income Pro Forma

The income pro forma estimates the potential income of the property over a specific period. The key components of the income pro forma include:

- Rental Income: Estimated monthly rental income per unit.

- Other Income: Estimated monthly other income, including laundry, parking, and vending machines.

- Total Income: Estimated monthly total income.

Expense Pro Forma

The expense pro forma estimates the potential expenses of the property over a specific period. The key components of the expense pro forma include:

- Property Taxes: Estimated annual property taxes.

- Insurance: Estimated annual insurance premiums.

- Maintenance: Estimated annual maintenance expenses.

- Management Fees: Estimated annual management fees.

Cash Flow Pro Forma

The cash flow pro forma estimates the potential cash flow of the property over a specific period. The key components of the cash flow pro forma include:

- Net Operating Income (NOI): Estimated annual NOI.

- Cash Flow Before Taxes: Estimated annual cash flow before taxes.

- Cash Flow After Taxes: Estimated annual cash flow after taxes.

Debt Service Pro Forma

The debt service pro forma estimates the potential debt service of the property over a specific period. The key components of the debt service pro forma include:

- Loan Payments: Estimated monthly loan payments, including principal and interest.

- Total Debt Service: Estimated annual total debt service.

Return on Investment (ROI) Pro Forma

The ROI pro forma estimates the potential return on investment of the property over a specific period. The key components of the ROI pro forma include:

- Cash-on-Cash Return: Estimated annual cash-on-cash return.

- Internal Rate of Return (IRR): Estimated annual IRR.

Conclusion

Creating an apartment pro forma Excel template can help you make informed decisions about investments, financing, and property management. By following the steps outlined in this article, you can create a comprehensive pro forma that estimates the potential income, expenses, cash flow, debt service, and return on investment of a property over a specific period.

What is a pro forma in real estate?

+A pro forma is a financial projection that estimates the potential income and expenses of a property over a specific period.

Why is pro forma analysis important in apartment investing?

+Pro forma analysis is essential in apartment investing as it helps you evaluate the potential financial performance of a property and make informed decisions about investments, financing, and property management.

What are the key components of an apartment pro forma?

+The key components of an apartment pro forma include income, expenses, cash flow, debt service, and return on investment (ROI).