Creating a capital lease amortization schedule is a crucial task for businesses that lease assets, such as equipment, vehicles, or property, under a capital lease agreement. In this article, we will break down the process into 5 easy steps to help you create a capital lease amortization schedule with ease.

Understanding Capital Leases

A capital lease, also known as a finance lease, is a type of lease agreement where the lessee (the party leasing the asset) assumes the majority of the risks and benefits associated with the asset. This type of lease is typically used for long-term leases, where the lessee has control over the asset and is responsible for its maintenance and upkeep.

Why is a Capital Lease Amortization Schedule Important?

A capital lease amortization schedule is essential for businesses that enter into capital lease agreements. It helps the lessee to:

- Record the lease payments accurately

- Calculate the interest expense and amortization of the lease

- Determine the asset's depreciation expense

- Make informed decisions about the lease agreement

Step 1: Gather Necessary Information

To create a capital lease amortization schedule, you will need to gather the following information:

- Lease term (number of years or months)

- Lease commencement date

- Lease payment amount and frequency (e.g., monthly, quarterly, annually)

- Interest rate ( implicit or explicit)

- Lease asset's fair value (at the commencement date)

- Residual value (estimated value of the asset at the end of the lease term)

Step 2: Calculate the Present Value of the Lease

The present value of the lease represents the total value of the lease payments discounted to the present date. You can calculate the present value using the following formula:

Present Value = ∑ (Lease Payment x (1 + Interest Rate)^(-n))

Where: n = number of periods (e.g., months, years)

Alternatively, you can use a financial calculator or spreadsheet software like Excel to calculate the present value.

Example:

Suppose you have a capital lease agreement with the following terms:

- Lease term: 5 years

- Lease commencement date: January 1, 2023

- Lease payment: $1,000 per month

- Interest rate: 6% per annum

- Lease asset's fair value: $50,000

Using the formula above, you can calculate the present value of the lease as follows:

Present Value = ∑ ($1,000 x (1 + 0.06/12)^(-60)) ≈ $49,419

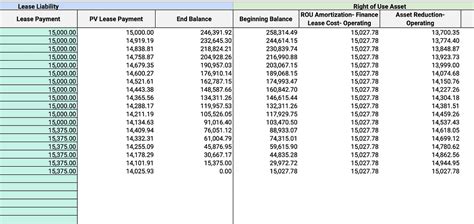

Step 3: Create an Amortization Schedule

An amortization schedule is a table that outlines the lease payments, interest expense, and amortization of the lease over the lease term. You can create an amortization schedule using the following steps:

- Calculate the total interest expense over the lease term

- Calculate the amortization of the lease for each period

- Calculate the outstanding balance after each lease payment

Example:

Using the same example as above, you can create an amortization schedule as follows:

| Period | Lease Payment | Interest Expense | Amortization | Outstanding Balance |

|---|---|---|---|---|

| 1 | $1,000 | $250 | $750 | $49,419 |

| 2 | $1,000 | $247 | $753 | $48,666 |

| 3 | $1,000 | $244 | $756 | $47,910 |

| ... | ... | ... | ... | ... |

| 60 | $1,000 | $123 | $877 | $0 |

Step 4: Calculate the Depreciation Expense

The depreciation expense represents the decrease in the asset's value over its useful life. You can calculate the depreciation expense using the following formula:

Depreciation Expense = (Asset's Fair Value - Residual Value) / Useful Life

Example:

Using the same example as above, you can calculate the depreciation expense as follows:

Depreciation Expense = ($50,000 - $10,000) / 5 years = $8,000 per year

Step 5: Review and Update the Amortization Schedule

It's essential to review and update the amortization schedule regularly to ensure that it reflects any changes in the lease agreement or the asset's value.

Example:

Suppose the lessee decides to renew the lease agreement for an additional 2 years. You will need to update the amortization schedule to reflect the new lease term and calculate the revised depreciation expense.

By following these 5 easy steps, you can create a capital lease amortization schedule that helps you manage your lease agreement and make informed decisions about your business.

We hope this article has helped you understand how to create a capital lease amortization schedule. If you have any questions or need further clarification, please don't hesitate to ask.

What is a capital lease?

+A capital lease is a type of lease agreement where the lessee assumes the majority of the risks and benefits associated with the asset.

How do I calculate the present value of a lease?

+You can calculate the present value of a lease using the formula: Present Value = ∑ (Lease Payment x (1 + Interest Rate)^(-n))

What is depreciation expense?

+Depreciation expense represents the decrease in the asset's value over its useful life.