Accurate cash drawer reconciliation is a crucial process for any business that handles cash transactions. It ensures that the cash in the drawer matches the amount recorded in the accounting system, helping to prevent errors, discrepancies, and potential theft. In this article, we will provide 7 tips for accurate cash drawer reconciliation, highlighting the importance of this process and offering practical advice on how to implement it effectively.

Reconciling your cash drawer is an essential task that should be performed regularly, typically at the end of each shift or day. It involves counting the cash in the drawer, verifying the amount against the sales records, and investigating any discrepancies. By following these 7 tips, you can ensure accurate cash drawer reconciliation and maintain the integrity of your financial records.

1. Establish a Clear Reconciliation Process

The first step in accurate cash drawer reconciliation is to establish a clear process. This involves defining the steps involved in the reconciliation process, including who is responsible for performing the task, how often it should be done, and what procedures should be followed. A well-defined process helps ensure that the reconciliation is performed consistently and accurately.

Key Components of a Reconciliation Process

- Define the frequency of reconciliation (e.g., daily, weekly)

- Identify the person responsible for performing the reconciliation

- Establish the procedures for counting cash, verifying sales records, and investigating discrepancies

- Determine the tolerable variance (if any)

2. Use a Standardized Reconciliation Form

Using a standardized reconciliation form helps ensure that the process is performed consistently and accurately. The form should include fields for recording the cash count, sales records, and any discrepancies. It should also include space for notes and explanations.

Benefits of a Standardized Reconciliation Form

- Ensures consistency in the reconciliation process

- Helps identify and investigate discrepancies

- Provides a clear audit trail

3. Count Cash Accurately

Accurate cash counting is critical to the reconciliation process. It involves counting the cash in the drawer, including coins and bills, and verifying the amount against the sales records.

Best Practices for Accurate Cash Counting

- Count cash in a secure, private area

- Use a cash tray or divider to separate denominations

- Verify the count with a second person (if possible)

- Record the count on the reconciliation form

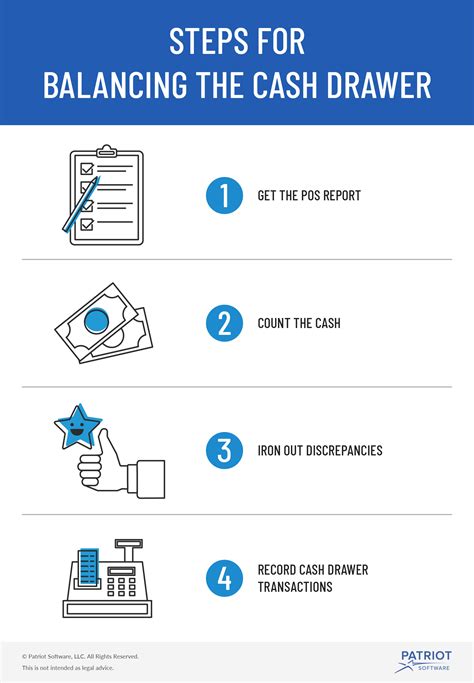

4. Verify Sales Records

Verifying sales records is an essential step in the reconciliation process. It involves comparing the cash count to the sales records to ensure that the two match.

Best Practices for Verifying Sales Records

- Use a sales report or summary to verify sales

- Compare the cash count to the sales records

- Investigate any discrepancies or variances

5. Investigate Discrepancies

Investigating discrepancies is a critical step in the reconciliation process. It involves identifying and resolving any variances between the cash count and sales records.

Best Practices for Investigating Discrepancies

- Identify the source of the discrepancy

- Investigate and resolve the discrepancy

- Document the resolution on the reconciliation form

6. Maintain a Audit Trail

Maintaining an audit trail is essential for ensuring the accuracy and integrity of the reconciliation process. It involves documenting each step of the process, including the cash count, sales records, and any discrepancies.

Benefits of an Audit Trail

- Provides a clear record of the reconciliation process

- Helps identify and investigate discrepancies

- Ensures accountability and transparency

7. Train Staff on the Reconciliation Process

Training staff on the reconciliation process is critical to ensuring its accuracy and effectiveness. It involves educating staff on the procedures, best practices, and importance of the reconciliation process.

Benefits of Training Staff

- Ensures consistency in the reconciliation process

- Helps identify and investigate discrepancies

- Improves accountability and transparency

Gallery of Cash Drawer Reconciliation:

FAQs:

What is cash drawer reconciliation?

+Cash drawer reconciliation is the process of verifying the cash in the drawer against the sales records to ensure accuracy and integrity.

Why is cash drawer reconciliation important?

+Cash drawer reconciliation is important because it helps prevent errors, discrepancies, and potential theft. It also ensures that the financial records are accurate and reliable.

How often should cash drawer reconciliation be performed?

+Cash drawer reconciliation should be performed regularly, typically at the end of each shift or day.