Calculating compound interest can be a daunting task, especially for those who are not familiar with the concept or don't have a background in finance. However, with the help of an Excel template, you can easily calculate compound interest and make informed decisions about your investments.

Compound interest is a powerful financial concept that can help your savings grow exponentially over time. It's a type of interest that is calculated on both the principal amount and any accrued interest, resulting in a snowball effect that can help your investments grow faster. Understanding how compound interest works and using a calculator to determine the future value of your investments can help you achieve your financial goals.

In this article, we'll explore the world of compound interest calculators in Excel, including how to create your own template from scratch and use pre-made templates to calculate compound interest. We'll also discuss the benefits of using an Excel template, how to interpret the results, and provide examples of how to use a compound interest calculator in real-world scenarios.

What is Compound Interest?

Before we dive into creating a compound interest calculator in Excel, let's take a step back and explore what compound interest is and how it works. Compound interest is a type of interest that is calculated on both the principal amount and any accrued interest. This means that the interest earned in previous periods is added to the principal amount, and the interest for the next period is calculated on the new principal balance.

For example, let's say you deposit $1,000 into a savings account that earns a 5% annual interest rate. At the end of the first year, you'll have earned $50 in interest, making your total balance $1,050. In the second year, the interest rate is applied to the new principal balance of $1,050, earning $52.50 in interest. This process continues, with the interest earned in each period added to the principal balance, resulting in a snowball effect that can help your investments grow faster.

How to Create a Compound Interest Calculator in Excel

Creating a compound interest calculator in Excel is a straightforward process that requires just a few formulas and some basic setup. Here's a step-by-step guide to creating a compound interest calculator from scratch:

- Open a new Excel spreadsheet and create a table with the following columns: Principal, Rate, Time, and Compound Interest.

- Enter the principal amount, interest rate, and time period into the corresponding columns.

- Use the formula

=IPMT(B2, B3, B4)to calculate the interest payment for each period, where B2 is the principal amount, B3 is the interest rate, and B4 is the time period. - Use the formula

=FV(B2, B3, B4)to calculate the future value of the investment, where B2 is the principal amount, B3 is the interest rate, and B4 is the time period. - Use the formula

=PV(B2, B3, B4)to calculate the present value of the investment, where B2 is the principal amount, B3 is the interest rate, and B4 is the time period.

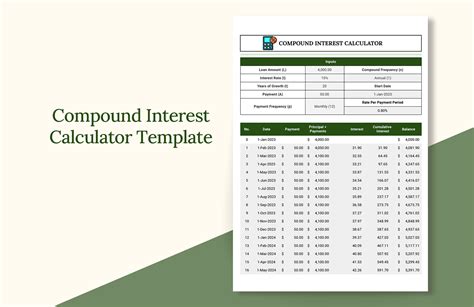

Here's an example of what the calculator might look like:

| Principal | Rate | Time | Compound Interest | Future Value | Present Value |

|---|---|---|---|---|---|

| 1000 | 0.05 | 10 | =IPMT(B2, B3, B4) | =FV(B2, B3, B4) | =PV(B2, B3, B4) |

Benefits of Using a Compound Interest Calculator in Excel

Using a compound interest calculator in Excel has several benefits, including:

- Easy to use: A compound interest calculator in Excel is easy to use and requires minimal setup.

- Fast and accurate: The calculator can quickly and accurately calculate compound interest, making it easier to make informed decisions about your investments.

- Customizable: You can customize the calculator to fit your specific needs, including changing the interest rate, time period, and principal amount.

- Flexible: You can use the calculator to calculate compound interest for a variety of investments, including savings accounts, CDs, and bonds.

Interpreting the Results

When using a compound interest calculator in Excel, it's essential to understand how to interpret the results. Here are a few tips:

- Understand the inputs: Make sure you understand the inputs, including the principal amount, interest rate, and time period.

- Review the calculations: Review the calculations to ensure that they are accurate and make sense.

- Analyze the results: Analyze the results to determine the future value of your investment and the total interest earned.

- Use the results to inform decisions: Use the results to inform decisions about your investments, including whether to invest in a particular asset or how much to contribute to a retirement account.

Examples of Using a Compound Interest Calculator in Real-World Scenarios

Here are a few examples of using a compound interest calculator in real-world scenarios:

- Savings account: Use a compound interest calculator to determine the future value of a savings account that earns a 2% annual interest rate.

- CD: Use a compound interest calculator to determine the future value of a CD that earns a 4% annual interest rate.

- Retirement account: Use a compound interest calculator to determine the future value of a retirement account that earns a 7% annual interest rate.

Conclusion

In conclusion, a compound interest calculator in Excel is a powerful tool that can help you make informed decisions about your investments. By creating a calculator from scratch or using a pre-made template, you can quickly and accurately calculate compound interest and determine the future value of your investments. Remember to interpret the results carefully and use the calculator to inform decisions about your investments.

What is compound interest?

+Compound interest is a type of interest that is calculated on both the principal amount and any accrued interest.

How do I create a compound interest calculator in Excel?

+To create a compound interest calculator in Excel, you'll need to use the IPMT and FV functions.

What are the benefits of using a compound interest calculator in Excel?

+The benefits of using a compound interest calculator in Excel include ease of use, fast and accurate calculations, and customization.