Receiving reimbursement for daycare expenses can be a hassle, especially when it comes to submitting receipts for Flexible Spending Account (FSA) claims. Having a well-organized and clear receipt template can make all the difference in ensuring a smooth reimbursement process. In this article, we will explore five essential FSA daycare receipt templates that you can use to simplify your expense tracking and submission.

The Importance of Accurate Receipts for FSA Daycare Claims

When submitting FSA claims for daycare expenses, it is crucial to include accurate and detailed receipts. This is because FSA administrators require receipts that clearly show the date, amount, and type of expense, as well as the name and address of the care provider. Without these essential details, your claim may be delayed or even denied.

5 Essential FSA Daycare Receipt Templates

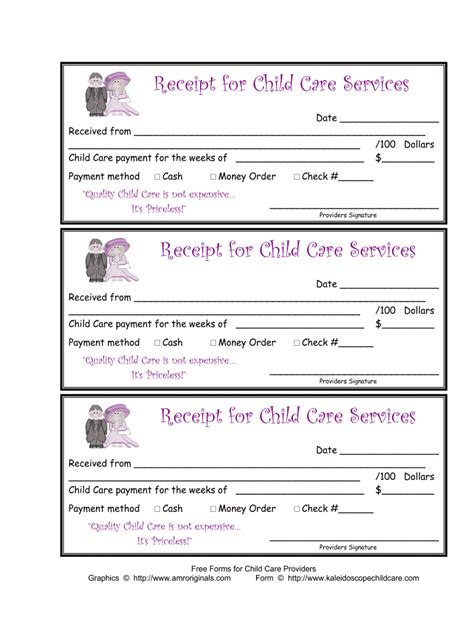

To help you create accurate and compliant receipts, we have put together five essential FSA daycare receipt templates. These templates are designed to meet the requirements of most FSA administrators and can be easily customized to fit your specific needs.

Template 1: Basic Daycare Receipt Template

This template provides a simple and straightforward format for documenting daycare expenses. It includes the following essential fields:

- Date of service

- Type of care (e.g., full-time, part-time, drop-in)

- Number of hours cared for

- Rate per hour

- Total amount due

Example of Completed Template:

| Date of Service | Type of Care | Number of Hours | Rate per Hour | Total Amount Due |

|---|---|---|---|---|

| 2023-02-20 | Full-time | 8 hours | $10.00 | $80.00 |

Template 2: Detailed Daycare Receipt Template

This template provides a more detailed format for documenting daycare expenses. It includes the following additional fields:

- Name and address of care provider

- Child's name and date of birth

- Description of services provided

Example of Completed Template:

| Date of Service | Type of Care | Number of Hours | Rate per Hour | Total Amount Due | Care Provider Name and Address |

|---|---|---|---|---|---|

| 2023-02-20 | Full-time | 8 hours | $10.00 | $80.00 | Jane Doe, 123 Main St, Anytown, USA |

Template 3: Daycare Invoice Template

This template provides a format for creating invoices for daycare services. It includes the following essential fields:

- Invoice number and date

- Name and address of care provider

- Child's name and date of birth

- Description of services provided

- Total amount due

Example of Completed Template:

| Invoice Number | Date | Care Provider Name and Address | Child's Name and Date of Birth | Description of Services | Total Amount Due |

|---|---|---|---|---|---|

| #001 | 2023-02-20 | Jane Doe, 123 Main St, Anytown, USA | John Smith, 2023-02-10 | Full-time care, 8 hours | $80.00 |

Template 4: Daily Daycare Log Template

This template provides a format for tracking daily daycare expenses. It includes the following essential fields:

- Date of service

- Type of care

- Number of hours cared for

- Rate per hour

- Total amount due

Example of Completed Template:

| Date of Service | Type of Care | Number of Hours | Rate per Hour | Total Amount Due |

|---|---|---|---|---|

| 2023-02-20 | Full-time | 8 hours | $10.00 | $80.00 |

| 2023-02-21 | Part-time | 4 hours | $12.00 | $48.00 |

Template 5: Quarterly Daycare Summary Template

This template provides a format for summarizing quarterly daycare expenses. It includes the following essential fields:

- Quarter and year

- Total number of hours cared for

- Total amount due

Example of Completed Template:

| Quarter and Year | Total Number of Hours | Total Amount Due |

|---|---|---|

| Q1 2023 | 400 hours | $4,000.00 |

Gallery of FSA Daycare Receipt Templates

FAQs

What is an FSA?

+An FSA, or Flexible Spending Account, is a type of savings account that allows you to set aside a portion of your income on a tax-free basis to pay for eligible expenses, such as daycare costs.

What expenses are eligible for reimbursement under an FSA?

+Eligible expenses under an FSA may include daycare costs, medical expenses, and other qualified expenses. The specific expenses that are eligible for reimbursement will depend on the terms of your FSA plan.

How do I submit a claim for reimbursement under my FSA?

+To submit a claim for reimbursement under your FSA, you will typically need to complete a claim form and provide supporting documentation, such as receipts or invoices. The specific steps for submitting a claim will depend on the terms of your FSA plan.

By using these five essential FSA daycare receipt templates, you can simplify the process of tracking and submitting expenses for reimbursement under your FSA plan. Remember to always keep accurate and detailed records of your expenses, and to follow the specific requirements of your FSA plan when submitting claims for reimbursement.