Effective financial management is crucial for the success of any business, and keeping track of deposits and invoices is a key part of this process. A deposit invoice template in Excel can be a valuable tool for easy record keeping, allowing you to streamline your financial operations and reduce the risk of errors.

Benefits of Using a Deposit Invoice Template in Excel

Using a deposit invoice template in Excel can provide numerous benefits for your business, including:

- Improved accuracy: By using a pre-designed template, you can minimize the risk of errors and ensure that your invoices and deposits are accurately recorded.

- Increased efficiency: A template can save you time and effort, allowing you to quickly and easily generate invoices and track deposits.

- Better organization: A deposit invoice template can help you keep your financial records organized and up-to-date, making it easier to track payments and manage your cash flow.

- Enhanced professionalism: A well-designed template can help you create professional-looking invoices and deposit records, which can enhance your business's reputation and credibility.

What to Include in a Deposit Invoice Template

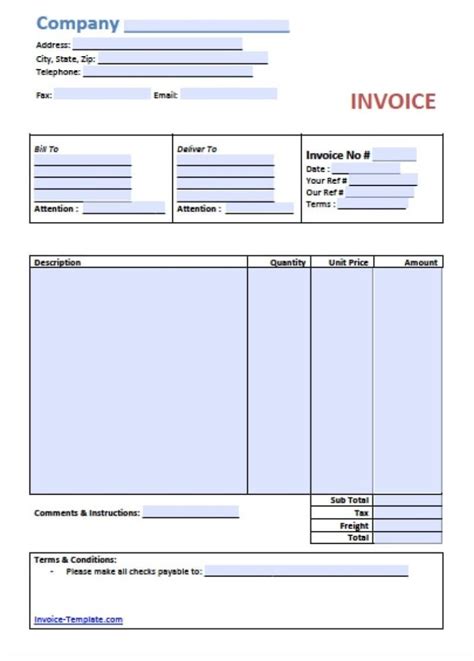

When creating a deposit invoice template in Excel, there are several key elements to include:

- Company information: Your business's name, address, and contact details.

- Invoice details: The date, invoice number, and description of the deposit.

- Customer information: The customer's name, address, and contact details.

- Deposit details: The amount of the deposit, the payment method, and any relevant notes or comments.

- Payment terms: The payment terms, including the due date and any applicable late fees.

How to Create a Deposit Invoice Template in Excel

Creating a deposit invoice template in Excel is a straightforward process that can be completed in a few steps:

- Open Excel: Launch Excel and create a new workbook.

- Design the template: Use Excel's built-in tools and features to design your template, including tables, formulas, and formatting.

- Add headers and footers: Add headers and footers to your template, including your business's name and contact details.

- Create tables and formulas: Create tables and formulas to automate the calculation of deposit amounts and payment terms.

- Format the template: Format the template to make it visually appealing and easy to use.

- Save the template: Save the template as an Excel file, such as "Deposit Invoice Template.xlsx".

Best Practices for Using a Deposit Invoice Template in Excel

When using a deposit invoice template in Excel, there are several best practices to keep in mind:

- Use clear and concise language: Use clear and concise language in your template to ensure that it is easy to understand and use.

- Keep the template up-to-date: Keep the template up-to-date by regularly reviewing and updating it to reflect changes in your business or financial operations.

- Use formulas and automation: Use formulas and automation to streamline your financial operations and reduce the risk of errors.

- Store the template securely: Store the template securely, such as in a password-protected folder or cloud storage service.

Common Mistakes to Avoid When Using a Deposit Invoice Template in Excel

When using a deposit invoice template in Excel, there are several common mistakes to avoid:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete, including company and customer details.

- Incorrect formulas or calculations: Double-check formulas and calculations to ensure that they are correct and accurate.

- Poor formatting: Ensure that the template is well-formatted and easy to read.

- Insufficient security: Ensure that the template is stored securely and protected from unauthorized access.

Deposit Invoice Template Excel Gallery

Conclusion

A deposit invoice template in Excel can be a valuable tool for easy record keeping and financial management. By including key elements such as company information, invoice details, and payment terms, you can create a template that is both functional and professional. By following best practices and avoiding common mistakes, you can ensure that your template is accurate, efficient, and secure.

What is a deposit invoice template?

+A deposit invoice template is a pre-designed document that helps businesses create professional-looking invoices and track deposits.

What are the benefits of using a deposit invoice template in Excel?

+The benefits of using a deposit invoice template in Excel include improved accuracy, increased efficiency, better organization, and enhanced professionalism.

How do I create a deposit invoice template in Excel?

+To create a deposit invoice template in Excel, simply open a new workbook, design the template, add headers and footers, create tables and formulas, format the template, and save it as an Excel file.