Dupont analysis is a widely used financial analysis technique that helps investors and analysts assess a company's financial performance and identify areas for improvement. However, manually performing a Dupont analysis can be a time-consuming and error-prone process. Fortunately, Excel templates can simplify the process, making it easier to analyze a company's financial data. In this article, we will discuss five ways to simplify Dupont analysis with Excel templates.

Financial performance is a critical aspect of a company's success, and Dupont analysis is a valuable tool for evaluating a company's financial health. By breaking down a company's return on equity (ROE) into its component parts, Dupont analysis provides a detailed picture of a company's profitability, efficiency, and leverage. However, manually performing a Dupont analysis can be a daunting task, requiring a significant amount of time and effort. This is where Excel templates come in – by simplifying the process and reducing errors.

What is Dupont Analysis?

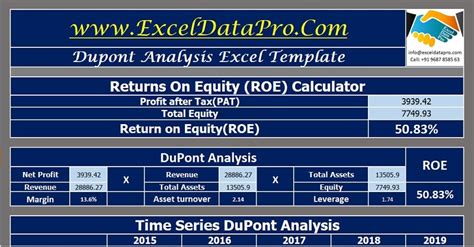

Dupont analysis is a financial analysis technique developed by the DuPont company in the 1920s. It is used to analyze a company's financial performance by breaking down its return on equity (ROE) into three component parts: profitability, efficiency, and leverage. The Dupont model is represented by the following equation:

ROE = (Net Profit Margin) x (Asset Turnover) x (Financial Leverage)

Each component of the equation provides valuable insights into a company's financial performance. The net profit margin measures a company's profitability, while the asset turnover measures its efficiency in using assets to generate sales. The financial leverage measures a company's use of debt to finance its operations.

How to Simplify Dupont Analysis with Excel Templates

Excel templates can simplify the Dupont analysis process in several ways. Here are five ways to simplify Dupont analysis with Excel templates:

1. Pre-Formatted Template

One of the most significant advantages of using an Excel template for Dupont analysis is that it provides a pre-formatted template. This template includes all the necessary formulas and formatting, making it easy to enter data and perform the analysis. By using a pre-formatted template, you can save time and reduce errors.

2. Automated Calculations

Another advantage of using an Excel template for Dupont analysis is that it automates calculations. The template includes formulas that automatically calculate the net profit margin, asset turnover, and financial leverage. This eliminates the need for manual calculations, reducing errors and saving time.

3. Easy Data Entry

Excel templates make it easy to enter data, which is a critical step in the Dupont analysis process. By using a template, you can simply enter the required data, such as net income, total assets, and total debt, and the template will automatically perform the calculations.

4. Visual Analysis

Excel templates can also be used to create visual aids, such as charts and graphs, to help analyze the data. By using visual aids, you can quickly identify trends and patterns in the data, making it easier to interpret the results of the Dupont analysis.

5. Scalability

Finally, Excel templates can be easily scaled up or down, depending on the size of the company or the complexity of the analysis. By using a template, you can perform a Dupont analysis on a small company or a large corporation, making it a versatile tool for financial analysis.

Benefits of Using Excel Templates for Dupont Analysis

Using Excel templates for Dupont analysis offers several benefits, including:

- Time Savings: Excel templates save time by automating calculations and eliminating the need for manual data entry.

- Reduced Errors: Excel templates reduce errors by providing a pre-formatted template and automating calculations.

- Improved Accuracy: Excel templates improve accuracy by ensuring that all calculations are performed correctly.

- Enhanced Analysis: Excel templates enhance analysis by providing visual aids and making it easier to interpret the results of the Dupont analysis.

Conclusion

Dupont analysis is a powerful tool for evaluating a company's financial performance. By using an Excel template, you can simplify the process and reduce errors. With its automated calculations, easy data entry, and visual analysis capabilities, an Excel template is an essential tool for any financial analyst or investor.

What is Dupont analysis?

+Dupont analysis is a financial analysis technique that breaks down a company's return on equity (ROE) into three component parts: profitability, efficiency, and leverage.

How does Dupont analysis work?

+Dupont analysis works by breaking down a company's ROE into three component parts: net profit margin, asset turnover, and financial leverage. These components are then used to calculate the company's ROE.

What are the benefits of using Dupont analysis?

+The benefits of using Dupont analysis include improved accuracy, enhanced analysis, and time savings. It also helps to identify areas for improvement in a company's financial performance.

We hope this article has provided valuable insights into the world of Dupont analysis and how to simplify it with Excel templates. If you have any questions or need further assistance, please don't hesitate to comment below.