As a business owner or freelancer, managing your finances and tax obligations can be overwhelming. One essential aspect of this is creating accurate and compliant pay stubs for yourself and your employees. In this article, we will discuss the importance of 1099 pay stubs, their requirements, and provide a free downloadable template to help you streamline your financial management.

The Importance of 1099 Pay Stubs

1099 pay stubs are crucial for independent contractors, freelancers, and small business owners who need to report their income and tax deductions to the IRS. These pay stubs serve as proof of income and are used to complete tax returns, obtain loans, and demonstrate financial stability.

Failure to provide accurate and timely 1099 pay stubs can result in penalties, fines, and even audits. Moreover, 1099 pay stubs help you keep track of your income, deductions, and tax obligations, making it easier to manage your finances and plan for the future.

Requirements for 1099 Pay Stubs

The IRS requires 1099 pay stubs to include specific information, such as:

- Payer's name, address, and tax identification number

- Recipient's name, address, and tax identification number

- Payment amount and date

- Type of payment (e.g., freelance work, consulting services)

- Tax withholding information (if applicable)

Creating a 1099 pay stub that meets these requirements can be time-consuming and prone to errors. That's why we've created a free downloadable template to help you get started.

1099 Pay Stub Template Free Download

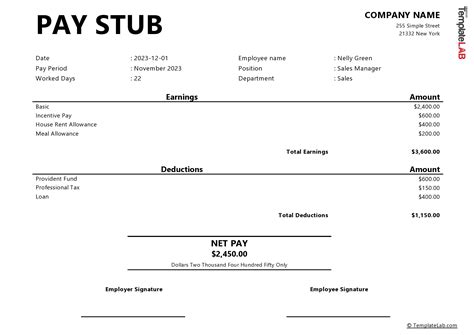

Our free 1099 pay stub template is designed to help you create accurate and compliant pay stubs quickly and easily. The template includes all the necessary fields and calculations to ensure you meet the IRS requirements.

Download the 1099 Pay Stub Template:

You can download the 1099 pay stub template in various formats, including Excel, Word, and PDF. Simply click on the link below to access the template.

[Insert link to download template]

How to Use the 1099 Pay Stub Template:

- Download the template and open it in your preferred software (e.g., Excel, Word).

- Enter the payer's and recipient's information, including names, addresses, and tax identification numbers.

- Input the payment amount, date, and type of payment.

- Calculate the tax withholding information (if applicable).

- Review and verify the accuracy of the pay stub.

Tips for Creating Accurate 1099 Pay Stubs

To ensure you create accurate and compliant 1099 pay stubs, follow these tips:

- Use a template to streamline the process and reduce errors.

- Verify the accuracy of the payer's and recipient's information.

- Calculate tax withholding correctly (if applicable).

- Keep a record of all pay stubs for at least three years.

Benefits of Using a 1099 Pay Stub Template

Using a 1099 pay stub template offers numerous benefits, including:

- Time-saving: Create pay stubs quickly and efficiently, reducing administrative burdens.

- Accuracy: Ensure compliance with IRS requirements and minimize errors.

- Organization: Keep track of your income, deductions, and tax obligations in one place.

- Convenience: Access the template anytime, anywhere, and make changes as needed.

Gallery of 1099 Pay Stub Templates

Explore our gallery of 1099 pay stub templates in various formats, including Excel, Word, and PDF. These templates are designed to help you create accurate and compliant pay stubs quickly and easily.

Conclusion

Creating accurate and compliant 1099 pay stubs is essential for managing your finances and tax obligations. Our free downloadable template is designed to help you streamline the process and reduce errors. By following the tips and using the template, you can ensure you meet the IRS requirements and maintain accurate records. Download the 1099 pay stub template today and take the first step towards efficient financial management.

Frequently Asked Questions

Q: What is a 1099 pay stub?

A: A 1099 pay stub is a document that reports income and tax deductions for independent contractors, freelancers, and small business owners.

Q: What information is required on a 1099 pay stub?

A: The IRS requires 1099 pay stubs to include the payer's and recipient's information, payment amount and date, type of payment, and tax withholding information (if applicable).

Q: Can I use a template to create 1099 pay stubs?

A: Yes, using a template can help you create accurate and compliant 1099 pay stubs quickly and easily.

Q: How do I download the 1099 pay stub template?

A: You can download the 1099 pay stub template in various formats, including Excel, Word, and PDF, by clicking on the link provided.

Q: What are the benefits of using a 1099 pay stub template?

A: Using a 1099 pay stub template offers numerous benefits, including time-saving, accuracy, organization, and convenience.

What is the purpose of a 1099 pay stub?

+A 1099 pay stub is used to report income and tax deductions for independent contractors, freelancers, and small business owners.

What information is required on a 1099 pay stub?

+The IRS requires 1099 pay stubs to include the payer's and recipient's information, payment amount and date, type of payment, and tax withholding information (if applicable).

Can I use a template to create 1099 pay stubs?

+Yes, using a template can help you create accurate and compliant 1099 pay stubs quickly and easily.