In today's fast-paced world, managing personal finances can be a daunting task. With the numerous financial responsibilities and expenses, it's easy to get overwhelmed and lose track of your spending. However, maintaining a record of your financial transactions is crucial to ensure you're staying within your budget and making progress towards your financial goals.

One effective way to organize your finances is by using a ledger. A ledger is a book or digital file that records all your financial transactions, providing a clear picture of your income and expenses. In this article, we'll explore the importance of using a ledger and provide you with six free printable ledger templates to help you get started.

Why Use a Ledger?

Using a ledger can bring numerous benefits to your financial management. Here are some of the reasons why you should consider using a ledger:

- Accurate financial tracking: A ledger helps you keep track of all your financial transactions, ensuring you have an accurate picture of your income and expenses.

- Budgeting: By monitoring your income and expenses, you can create a realistic budget that helps you stay within your means.

- Identifying areas for improvement: A ledger helps you identify areas where you can cut back on unnecessary expenses and make adjustments to improve your financial situation.

- Reducing stress: Keeping track of your finances can be stressful, but using a ledger can help you feel more in control and organized.

Types of Ledgers

There are several types of ledgers you can use, depending on your specific financial needs. Here are some of the most common types of ledgers:

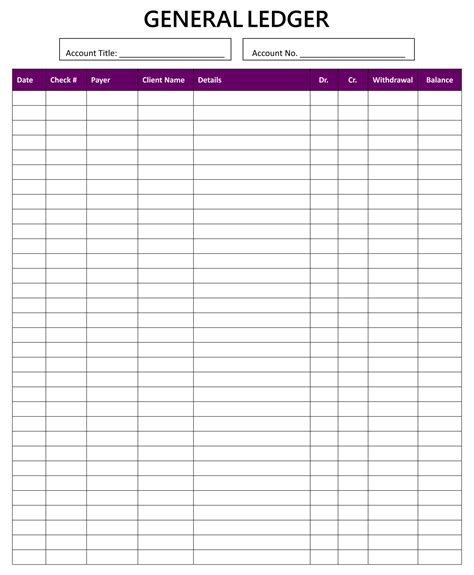

- General ledger: A general ledger is a comprehensive record of all your financial transactions, including income, expenses, assets, and liabilities.

- Cash ledger: A cash ledger is a record of all your cash transactions, including income, expenses, and cash flow.

- Accounts payable ledger: An accounts payable ledger is a record of all your outstanding debts and expenses that need to be paid.

Free Printable Ledger Templates

Here are six free printable ledger templates you can use to organize your finances:

Template 1: Simple Ledger Template

This template provides a basic ledger layout with columns for date, description, income, and expenses. You can use this template to record your daily financial transactions.

Template 2: Personal Finance Ledger Template

This template is designed for personal finance management and includes columns for income, fixed expenses, variable expenses, and savings. You can use this template to track your personal finances and stay within your budget.

Template 3: Business Ledger Template

This template is designed for business use and includes columns for income, expenses, assets, and liabilities. You can use this template to track your business finances and make informed decisions.

Template 4: Cash Flow Ledger Template

This template is designed to track your cash flow and includes columns for income, expenses, and cash balance. You can use this template to manage your cash flow and make sure you have enough funds to meet your financial obligations.

Template 5: Budget Ledger Template

This template is designed to help you create a budget and includes columns for income, fixed expenses, variable expenses, and savings. You can use this template to track your expenses and stay within your budget.

Template 6: Accounts Payable Ledger Template

This template is designed to track your outstanding debts and expenses and includes columns for date, description, amount, and payment status. You can use this template to manage your accounts payable and ensure you're paying your bills on time.

How to Use a Ledger

Using a ledger is a straightforward process that requires you to record all your financial transactions in a systematic and organized manner. Here are the steps to follow:

- Choose a ledger template: Select a ledger template that suits your financial needs. You can use one of the templates provided above or create your own custom template.

- Set up your ledger: Set up your ledger by adding columns for date, description, income, and expenses. You can also add additional columns for specific financial transactions, such as cash flow or accounts payable.

- Record your transactions: Record all your financial transactions in your ledger, including income, expenses, and cash flow. Make sure to date each transaction and provide a brief description.

- Update your ledger regularly: Update your ledger regularly to ensure you have an accurate picture of your financial situation. You can update your ledger daily, weekly, or monthly, depending on your financial needs.

- Review and analyze your ledger: Review and analyze your ledger regularly to identify areas for improvement and make informed financial decisions.

Conclusion

Using a ledger is an effective way to organize your finances and make progress towards your financial goals. By using one of the free printable ledger templates provided above, you can create a system that works for you and helps you stay on top of your finances. Remember to update your ledger regularly and review it periodically to ensure you're on track to achieving your financial objectives.

Gallery of Ledger Templates

What is a ledger?

+A ledger is a book or digital file that records all your financial transactions, providing a clear picture of your income and expenses.

Why do I need a ledger?

+A ledger helps you keep track of your financial transactions, identify areas for improvement, and make informed financial decisions.

How do I use a ledger?

+Choose a ledger template, set up your ledger, record your transactions, update your ledger regularly, and review and analyze your ledger periodically.