In the state of Arizona, a promissory note is a legally binding document that outlines the terms and conditions of a loan between two parties. It serves as a promise by the borrower to repay the loan, including the principal amount, interest, and any fees, to the lender. If you're in need of a promissory note template specific to Arizona, you can download a free template to help you create a comprehensive and enforceable agreement.

Understanding the Importance of a Promissory Note

A promissory note is an essential document in any lending transaction, as it provides a clear understanding of the loan terms and protects both the lender's and borrower's interests. Without a promissory note, it can be challenging to resolve disputes or collect debts. In Arizona, a promissory note can be used for various types of loans, including personal loans, business loans, and real estate loans.

Key Components of an Arizona Promissory Note Template

When creating a promissory note template for Arizona, it's crucial to include the following essential elements:

- Parties Involved: Identify the borrower and lender, including their names, addresses, and contact information.

- Loan Amount: Specify the principal amount borrowed, including any interest or fees.

- Interest Rate: State the interest rate applicable to the loan, including the type of interest (e.g., fixed or variable).

- Repayment Terms: Outline the repayment schedule, including the frequency and amount of payments.

- Default Provisions: Specify the consequences of default, including late fees, penalties, and acceleration of the loan.

- Governing Law: Indicate that the promissory note is governed by Arizona law.

Arizona Free Promissory Note Template Download

You can download a free Arizona promissory note template to help you create a comprehensive and enforceable agreement. The template should include the essential elements outlined above and be tailored to Arizona state laws.

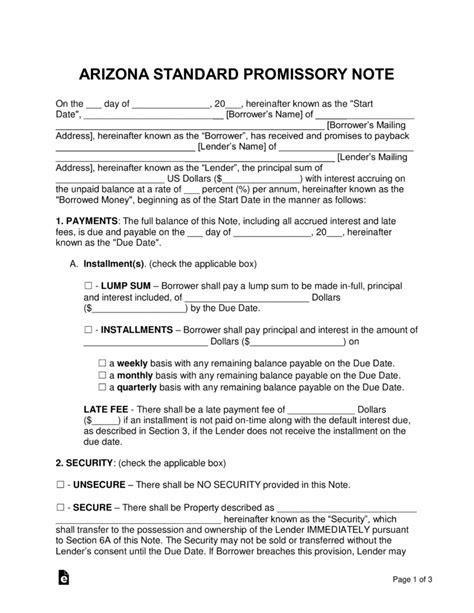

Here's an example of what the template might look like:

How to Use the Arizona Promissory Note Template

To use the template effectively, follow these steps:

- Fill in the Parties: Insert the names, addresses, and contact information of the borrower and lender.

- Specify the Loan Terms: Enter the loan amount, interest rate, repayment schedule, and default provisions.

- Review and Sign: Carefully review the template, and have both parties sign and date the document.

- Keep a Record: Maintain a copy of the signed promissory note for your records.

Additional Resources

For more information on Arizona promissory notes, you can consult the following resources:

- Arizona Revised Statutes: Review the state's laws and regulations regarding promissory notes.

- Arizona State Bar Association: Consult with an attorney or seek guidance from the state bar association.

By using an Arizona free promissory note template, you can create a comprehensive and enforceable agreement that protects both the lender's and borrower's interests.