Creating a legally binding promissory note in Washington State requires a clear understanding of the agreement's terms and the state's specific laws. A promissory note is a written promise to repay a debt, and using a template can help ensure that all necessary information is included. In this article, we will discuss the importance of a promissory note, its components, and provide a downloadable template for Washington State.

Why Use a Promissory Note in Washington State?

A promissory note is a crucial document in any lending transaction, as it outlines the borrower's promise to repay the loan, including the amount, interest rate, and repayment terms. In Washington State, a promissory note can help prevent misunderstandings and disputes by clearly defining the agreement's terms.

Components of a Promissory Note in Washington State

A valid promissory note in Washington State should include the following essential components:

- Loan Amount: The amount borrowed by the borrower.

- Interest Rate: The rate at which interest will be charged on the loan.

- Repayment Terms: The schedule for repaying the loan, including the payment amount, frequency, and due date.

- Borrower's Information: The borrower's name, address, and contact information.

- Lender's Information: The lender's name, address, and contact information.

- Default and Late Payment Provisions: The consequences of missing a payment or defaulting on the loan.

- Governing Law: The state laws that will govern the agreement.

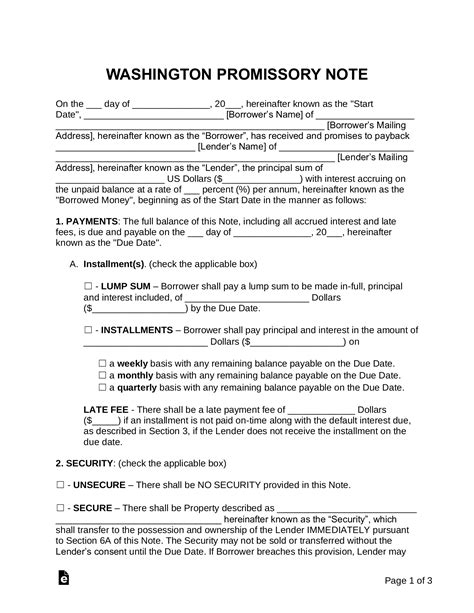

Washington State Free Promissory Note Template Download

To create a valid promissory note in Washington State, you can download and use our free template. This template includes all the necessary components to ensure that your agreement is clear and enforceable.

Please note that while this template is designed to meet Washington State's requirements, it is essential to consult with an attorney to ensure that your specific situation is addressed.

Filling Out the Promissory Note Template

When filling out the template, make sure to include the following information:

- Loan Amount: Enter the amount borrowed by the borrower.

- Interest Rate: Enter the interest rate charged on the loan.

- Repayment Terms: Enter the repayment schedule, including the payment amount, frequency, and due date.

- Borrower's Information: Enter the borrower's name, address, and contact information.

- Lender's Information: Enter the lender's name, address, and contact information.

- Default and Late Payment Provisions: Enter the consequences of missing a payment or defaulting on the loan.

- Governing Law: Enter the state laws that will govern the agreement.

Benefits of Using a Promissory Note Template

Using a promissory note template can help you create a clear and enforceable agreement, reducing the risk of misunderstandings and disputes. A template can also save you time and money by providing a pre-drafted document that meets Washington State's requirements.

Tips for Using a Promissory Note Template

- Read and Understand the Template: Before filling out the template, read and understand the agreement's terms.

- Seek Professional Advice: Consult with an attorney to ensure that your specific situation is addressed.

- Fill Out the Template Carefully: Enter all the necessary information accurately and completely.

- Sign and Date the Agreement: Both parties must sign and date the agreement to make it binding.

Gallery of Washington State Promissory Note Templates

Frequently Asked Questions

What is a promissory note?

+A promissory note is a written promise to repay a debt.

Why do I need a promissory note in Washington State?

+A promissory note helps prevent misunderstandings and disputes by clearly defining the agreement's terms.

Can I use a promissory note template in Washington State?

+Yes, you can use a promissory note template in Washington State, but it's essential to consult with an attorney to ensure that your specific situation is addressed.

In conclusion, a promissory note is a vital document in any lending transaction in Washington State. By using a template, you can create a clear and enforceable agreement that reduces the risk of misunderstandings and disputes. Remember to read and understand the template, seek professional advice, fill out the template carefully, and sign and date the agreement to make it binding.