Managing debt can be a daunting task, but with the right tools and strategies, it's possible to pay off debt and achieve financial freedom. One powerful tool that can help you stay on top of your debt is Google Sheets. In this article, we'll explore seven ways to pay off debt using a Google Sheets template.

Understanding the Importance of Debt Management

Before we dive into the strategies, it's essential to understand the importance of debt management. Debt can be overwhelming, and if left unchecked, it can lead to financial stress, damaged credit scores, and even bankruptcy. By taking control of your debt, you can:

- Reduce financial stress and anxiety

- Improve your credit score

- Free up more money in your budget for savings and investments

- Achieve long-term financial stability

7 Ways to Pay Off Debt with Google Sheets Template

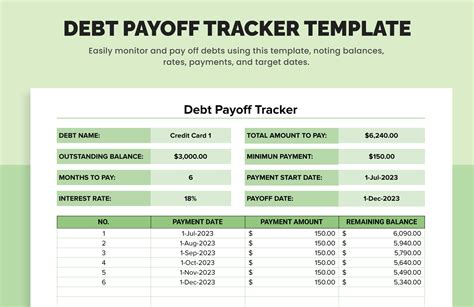

A Google Sheets template can help you track your debt, create a budget, and develop a plan to pay off your debt. Here are seven ways to pay off debt using a Google Sheets template:

1. Debt Snowball Method

The debt snowball method involves paying off your debts in a specific order, starting with the smallest balance first. This approach can help you build momentum and see progress quickly.

- Create a table in your Google Sheets template to list all your debts, including the balance, interest rate, and minimum payment.

- Sort the table by balance, from smallest to largest.

- Pay the minimum payment on all debts except the smallest one, which you'll pay off as aggressively as possible.

- Once you've paid off the smallest debt, move on to the next one, and so on.

2. Debt Avalanche Method

The debt avalanche method involves paying off your debts in a specific order, starting with the one with the highest interest rate. This approach can save you the most money in interest over time.

- Create a table in your Google Sheets template to list all your debts, including the balance, interest rate, and minimum payment.

- Sort the table by interest rate, from highest to lowest.

- Pay the minimum payment on all debts except the one with the highest interest rate, which you'll pay off as aggressively as possible.

- Once you've paid off the debt with the highest interest rate, move on to the next one, and so on.

3. Consolidation Method

The consolidation method involves combining multiple debts into one loan with a lower interest rate and a single monthly payment.

- Create a table in your Google Sheets template to list all your debts, including the balance, interest rate, and minimum payment.

- Research and compare consolidation loan options to find the best interest rate and terms.

- Apply for the consolidation loan and use the funds to pay off your existing debts.

- Make a single monthly payment on the consolidation loan.

4. Snowflaking Method

The snowflaking method involves making small, extra payments towards your debt whenever possible.

- Create a table in your Google Sheets template to list all your debts, including the balance, interest rate, and minimum payment.

- Identify areas in your budget where you can cut back and allocate the savings towards your debt.

- Make small, extra payments towards your debt whenever possible.

5. Debt Management Plan (DMP) Method

A DMP involves working with a credit counselor to create a plan to pay off your debt.

- Create a table in your Google Sheets template to list all your debts, including the balance, interest rate, and minimum payment.

- Research and find a reputable credit counseling agency.

- Work with the credit counselor to create a personalized DMP.

- Make monthly payments to the credit counseling agency, which will distribute the funds to your creditors.

6. Negotiation Method

The negotiation method involves contacting your creditors to negotiate a settlement or reduced payment plan.

- Create a table in your Google Sheets template to list all your debts, including the balance, interest rate, and minimum payment.

- Research and gather information on your creditors' settlement policies.

- Contact your creditors and negotiate a settlement or reduced payment plan.

7. Budgeting Method

The budgeting method involves creating a budget and allocating as much money as possible towards your debt.

- Create a table in your Google Sheets template to list all your income and expenses.

- Identify areas in your budget where you can cut back and allocate the savings towards your debt.

- Make a plan to allocate as much money as possible towards your debt each month.

Gallery of Debt Management Strategies

FAQs

What is the best way to pay off debt?

+The best way to pay off debt depends on your individual financial situation and goals. Consider using a debt snowball or debt avalanche method, or working with a credit counselor to create a personalized plan.

How can I track my debt?

+Use a Google Sheets template to track your debt, including the balance, interest rate, and minimum payment for each debt. You can also use a budgeting app or spreadsheet to track your income and expenses.

What is debt consolidation?

+Debt consolidation involves combining multiple debts into one loan with a lower interest rate and a single monthly payment. This can help simplify your finances and save money on interest.

By using a Google Sheets template and one of the seven methods outlined above, you can take control of your debt and achieve financial freedom. Remember to stay consistent, stay patient, and celebrate your progress along the way.