Living with debt can be overwhelming and stressful. The pressure to make payments, manage interest rates, and balance multiple debts can be a heavy burden. However, with the right tools and strategies, it is possible to pay off debt and start fresh. One of the most effective ways to take control of your debt is by using a Google Sheets template.

Why Use a Google Sheets Template to Pay Off Debt?

A Google Sheets template is a powerful tool that can help you manage your debt and create a plan to pay it off. With a template, you can:

- Track your income and expenses

- List all your debts, including balance, interest rate, and minimum payment

- Create a budget and prioritize your spending

- Set realistic goals and deadlines for paying off your debt

- Visualize your progress and stay motivated

The Benefits of Using a Google Sheets Template to Pay Off Debt

Using a Google Sheets template to pay off debt has several benefits. Here are some of the most significant advantages:

- Customizable: A Google Sheets template can be tailored to your specific needs and financial situation. You can add or remove columns, rows, and formulas to suit your requirements.

- Easy to use: Google Sheets is a user-friendly platform that is easy to navigate, even for those who are not tech-savvy.

- Collaborative: Google Sheets allows you to share your template with a partner or financial advisor, making it easier to work together to pay off debt.

- Automated calculations: Google Sheets can perform calculations automatically, saving you time and reducing the risk of errors.

- Track progress: With a Google Sheets template, you can track your progress and see how far you've come in paying off your debt.

How to Create a Google Sheets Template to Pay Off Debt

Creating a Google Sheets template to pay off debt is a straightforward process. Here's a step-by-step guide to help you get started:

Step 1: Set up a new Google Sheet

- Go to Google Drive and click on the "New" button.

- Select "Google Sheets" from the dropdown menu.

- Give your sheet a name, such as "Debt Repayment Plan."

Step 2: Create a budget sheet

- Create a new sheet by clicking on the "Insert" menu and selecting "Sheet."

- Name this sheet "Budget."

- Set up columns for:

- Income

- Fixed expenses (rent, utilities, etc.)

- Variable expenses (entertainment, groceries, etc.)

- Debt payments

- Savings

Step 3: Create a debt sheet

- Create a new sheet by clicking on the "Insert" menu and selecting "Sheet."

- Name this sheet "Debt."

- Set up columns for:

- Debt type (credit card, loan, etc.)

- Balance

- Interest rate

- Minimum payment

- Total interest paid

Step 4: Create a payment plan sheet

- Create a new sheet by clicking on the "Insert" menu and selecting "Sheet."

- Name this sheet "Payment Plan."

- Set up columns for:

- Debt type

- Payment amount

- Payment frequency (monthly, bi-weekly, etc.)

- Total payments made

Step 5: Set up formulas and calculations

- Use formulas to calculate your total income, total expenses, and total debt.

- Use formulas to calculate your debt-to-income ratio and credit utilization ratio.

- Use formulas to track your progress and calculate how much you've paid off.

Google Sheets Template for Paying Off Debt

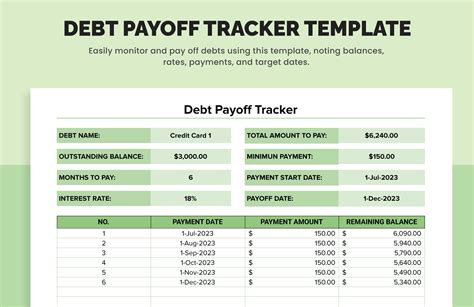

If you're not comfortable creating a template from scratch, you can use a pre-made Google Sheets template for paying off debt. Here's an example of what the template might look like:

| Debt Type | Balance | Interest Rate | Minimum Payment | Total Interest Paid |

|---|---|---|---|---|

| Credit Card | $2,000 | 18% | $50 | $1,000 |

| Car Loan | $10,000 | 6% | $200 | $2,000 |

| Student Loan | $30,000 | 4% | $100 | $5,000 |

| Payment Plan | Payment Amount | Payment Frequency | Total Payments Made |

|---|---|---|---|

| Credit Card | $500 | Monthly | $5,000 |

| Car Loan | $500 | Monthly | $10,000 |

| Student Loan | $200 | Bi-Weekly | $10,000 |

Tips for Using a Google Sheets Template to Pay Off Debt

Here are some tips for using a Google Sheets template to pay off debt:

- Regularly update your template: Make sure to update your template regularly to reflect any changes in your income, expenses, or debt.

- Use the 50/30/20 rule: Allocate 50% of your income towards fixed expenses, 30% towards discretionary spending, and 20% towards debt repayment and savings.

- Prioritize your debts: Prioritize your debts by focusing on the ones with the highest interest rates or the smallest balances.

- Automate your payments: Set up automatic payments to ensure that you never miss a payment.

- Review and adjust: Regularly review your template and adjust your plan as needed.

Conclusion

Paying off debt can be a daunting task, but with the right tools and strategies, it is possible to take control of your finances and start fresh. A Google Sheets template is a powerful tool that can help you manage your debt and create a plan to pay it off. By following the steps outlined in this article, you can create a customized template that suits your needs and financial situation. Remember to regularly update your template, use the 50/30/20 rule, prioritize your debts, automate your payments, and review and adjust your plan as needed.

FAQ Section

Q: What is the best way to pay off debt? A: The best way to pay off debt is to create a plan and stick to it. Consider using the debt snowball method or debt avalanche method to prioritize your debts.

Q: How can I automate my debt payments? A: You can automate your debt payments by setting up automatic transfers from your checking account to your debt accounts.

Q: What is the 50/30/20 rule? A: The 50/30/20 rule is a budgeting rule that allocates 50% of your income towards fixed expenses, 30% towards discretionary spending, and 20% towards debt repayment and savings.

Q: How often should I review my debt repayment plan? A: You should review your debt repayment plan regularly to ensure that you're on track to meet your goals. Consider reviewing your plan every 3-6 months.