In-Home Supportive Services (IHSS) is a program that provides financial assistance to low-income elderly, blind, or disabled individuals who require assistance with daily living tasks. One of the essential tools for IHSS providers is the pay stub template. In this article, we will guide you through the process of downloading a free IHSS pay stub template and provide a comprehensive guide on how to use it.

Why Do You Need an IHSS Pay Stub Template?

As an IHSS provider, you need to keep track of your hours worked, wages earned, and deductions made. A pay stub template helps you to organize this information in a clear and concise manner. It also serves as a record of your employment and payment history, which can be useful for tax purposes or in case of any disputes.

Benefits of Using an IHSS Pay Stub Template

Using an IHSS pay stub template offers several benefits, including:

- Easy tracking of hours worked and wages earned

- Accurate calculation of deductions and taxes

- Clear and concise record-keeping

- Compliance with state and federal labor laws

- Simplified tax preparation

Where to Download a Free IHSS Pay Stub Template

You can download a free IHSS pay stub template from various websites, including:

- California Department of Social Services (CDSS)

- IHSS website

- Online template providers such as Template.net or Microsoft Office Online

When downloading a template, make sure to choose one that is specifically designed for IHSS providers and complies with California state labor laws.

How to Use an IHSS Pay Stub Template

Using an IHSS pay stub template is relatively straightforward. Here's a step-by-step guide:

- Enter your information: Start by entering your name, address, and Social Security number.

- Enter your employer's information: Enter your employer's name, address, and Federal Employer Identification Number (FEIN).

- Enter your pay period: Enter the pay period dates, including the start and end dates.

- Enter your hours worked: Enter the number of hours you worked during the pay period.

- Enter your wages earned: Enter your hourly wage and calculate your total wages earned.

- Enter deductions: Enter any deductions made, such as taxes, union dues, or health insurance premiums.

- Calculate net pay: Calculate your net pay by subtracting deductions from your total wages earned.

Tips for Using an IHSS Pay Stub Template

Here are some tips to keep in mind when using an IHSS pay stub template:

- Keep accurate records: Make sure to keep accurate records of your hours worked and wages earned.

- Use a separate template for each pay period: Use a separate template for each pay period to ensure that you can track your earnings and deductions accurately.

- Review and verify: Review and verify your pay stub template regularly to ensure that it is accurate and complete.

Gallery of IHSS Pay Stub Templates

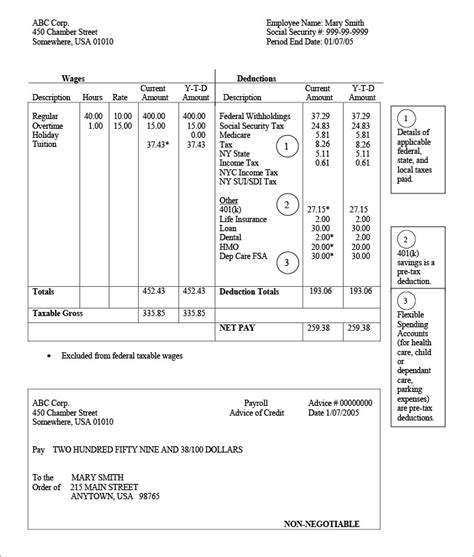

Here are some examples of IHSS pay stub templates:

FAQs

Here are some frequently asked questions about IHSS pay stub templates:

What is an IHSS pay stub template?

+An IHSS pay stub template is a document that outlines an IHSS provider's hours worked, wages earned, and deductions made.

Why do I need an IHSS pay stub template?

+You need an IHSS pay stub template to keep track of your hours worked and wages earned, as well as to comply with state and federal labor laws.

Where can I download a free IHSS pay stub template?

+You can download a free IHSS pay stub template from various websites, including the California Department of Social Services (CDSS) and online template providers.

By using an IHSS pay stub template, you can ensure that you are accurately tracking your hours worked and wages earned, as well as complying with state and federal labor laws. Remember to keep accurate records and review your pay stub template regularly to ensure that it is accurate and complete.