As an independent contractor, managing finances and keeping track of payments can be a daunting task. One essential tool for freelancers is a pay stub template. A pay stub, also known as a pay slip or wage slip, is a document that shows an employee's or contractor's pay details, including gross earnings, taxes, deductions, and net pay. In this article, we'll explore five free independent contractor pay stub templates that you can use to streamline your financial record-keeping.

Why Do Independent Contractors Need Pay Stub Templates?

As an independent contractor, you're responsible for managing your own finances, including tracking income, expenses, and taxes. A pay stub template helps you keep accurate records of your earnings, which is essential for tax purposes, invoicing clients, and managing your cash flow. Having a professional-looking pay stub also helps establish credibility with clients and financial institutions.

5 Free Independent Contractor Pay Stub Templates

Here are five free independent contractor pay stub templates that you can download and customize to suit your needs:

- Microsoft Word Pay Stub Template

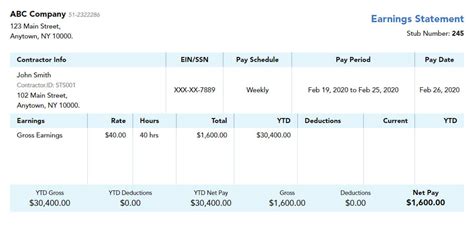

Microsoft offers a free pay stub template for Word that you can download from their website. This template includes fields for gross pay, taxes, deductions, and net pay, as well as a section for notes and comments.

[Image: Microsoft Word Pay Stub Template]

- Google Docs Pay Stub Template

Google Docs offers a free pay stub template that you can access from their template gallery. This template includes fields for pay period, pay date, gross pay, taxes, deductions, and net pay.

[Image: Google Docs Pay Stub Template]

- Pay Stub Template from Vertex42

Vertex42 offers a free pay stub template that you can download in Microsoft Excel format. This template includes fields for pay period, pay date, gross pay, taxes, deductions, and net pay, as well as a section for calculating overtime pay.

[Image: Vertex42 Pay Stub Template]

- Pay Stub Template from Microsoft Excel

Microsoft Excel offers a free pay stub template that you can download from their website. This template includes fields for pay period, pay date, gross pay, taxes, deductions, and net pay, as well as a section for calculating vacation pay.

[Image: Microsoft Excel Pay Stub Template]

- Pay Stub Template from OpenOffice

OpenOffice offers a free pay stub template that you can download in Microsoft Word format. This template includes fields for pay period, pay date, gross pay, taxes, deductions, and net pay, as well as a section for notes and comments.

[Image: OpenOffice Pay Stub Template]

Customizing Your Pay Stub Template

Once you've downloaded a pay stub template, you can customize it to suit your needs. Here are some tips for customizing your pay stub template:

- Add your company logo and contact information to the template.

- Include fields for specific deductions, such as health insurance or retirement contributions.

- Use formulas to calculate taxes, deductions, and net pay.

- Add a section for notes and comments to include any additional information.

Gallery of Pay Stub Templates

Here's a gallery of pay stub templates to help you get started:

Frequently Asked Questions

Here are some frequently asked questions about pay stub templates:

What is a pay stub template?

+A pay stub template is a document that shows an employee's or contractor's pay details, including gross earnings, taxes, deductions, and net pay.

Why do I need a pay stub template?

+A pay stub template helps you keep accurate records of your earnings, which is essential for tax purposes, invoicing clients, and managing your cash flow.

How do I customize a pay stub template?

+You can customize a pay stub template by adding your company logo and contact information, including fields for specific deductions, and using formulas to calculate taxes, deductions, and net pay.

We hope this article has helped you find the perfect pay stub template for your independent contracting business. Remember to customize your template to suit your needs and keep accurate records of your earnings.