When it comes to Alabama promissory note templates, it's essential to understand the intricacies of creating a legally binding document that protects both the lender and the borrower. A promissory note is a written promise to repay a debt, and having a well-crafted template can help prevent potential disputes and ensure a smooth transaction. Here are five tips to consider when creating an Alabama promissory note template.

Understanding Alabama Laws and Regulations

Before creating a promissory note template, it's crucial to familiarize yourself with Alabama laws and regulations regarding promissory notes. Alabama follows the Uniform Commercial Code (UCC), which governs promissory notes and other commercial transactions. Understanding the UCC and Alabama state laws will help you create a template that complies with all relevant regulations.

Clearly Define the Parties and Terms

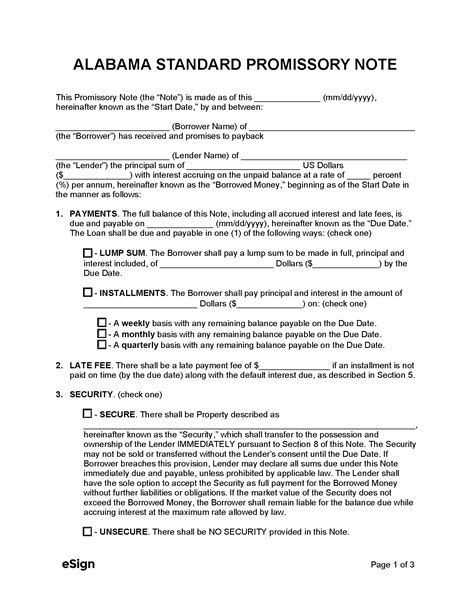

A promissory note template should clearly define the parties involved, including the lender (also known as the payee) and the borrower (also known as the maker). The template should also outline the terms of the loan, including the loan amount, interest rate, repayment terms, and any collateral or security interests. Make sure to include the following essential elements:

- The borrower's name and address

- The lender's name and address

- The loan amount and interest rate

- The repayment terms, including the payment schedule and due dates

- Any collateral or security interests

Include Essential Provisions and Disclosures

A well-crafted promissory note template should include essential provisions and disclosures to protect both parties. Some of these provisions include:

- A statement indicating that the borrower is obligated to repay the loan

- A description of the loan's interest rate and how it will be calculated

- A statement indicating that the loan is secured by collateral or a security interest (if applicable)

- A disclosure of any fees or charges associated with the loan

- A statement indicating that the borrower has the right to prepay the loan without penalty

Use a Professional and Clear Format

When creating a promissory note template, use a professional and clear format that is easy to read and understand. Avoid using ambiguous language or complicated jargon that may confuse the parties involved. Use headings and subheadings to organize the template, and make sure to leave sufficient space for signatures and dates.

Review and Update the Template Regularly

Finally, it's essential to review and update the promissory note template regularly to ensure it remains compliant with changing laws and regulations. Alabama laws and regulations regarding promissory notes may change over time, so it's crucial to stay up-to-date and make any necessary revisions to the template.

By following these five tips, you can create an Alabama promissory note template that is comprehensive, clear, and compliant with relevant laws and regulations.

Benefits of Using an Alabama Promissory Note Template

Using an Alabama promissory note template can provide several benefits, including:

- Protection for both the lender and the borrower

- Clarity and understanding of the loan terms and conditions

- Compliance with Alabama laws and regulations

- Reduced risk of disputes and misunderstandings

- Professional and clear format that is easy to read and understand

Common Mistakes to Avoid

When creating an Alabama promissory note template, there are several common mistakes to avoid, including:

- Failing to clearly define the parties and terms

- Omitting essential provisions and disclosures

- Using ambiguous language or complicated jargon

- Failing to review and update the template regularly

- Not obtaining signatures and dates

By avoiding these common mistakes, you can create an effective and comprehensive Alabama promissory note template that protects both parties and ensures a smooth transaction.

Frequently Asked Questions

Here are some frequently asked questions about Alabama promissory note templates:

- What is a promissory note? A promissory note is a written promise to repay a debt.

- What are the essential elements of a promissory note template? The essential elements of a promissory note template include the parties' names and addresses, the loan amount and interest rate, the repayment terms, and any collateral or security interests.

- How often should I review and update the promissory note template? You should review and update the promissory note template regularly to ensure it remains compliant with changing laws and regulations.

What is a promissory note?

+A promissory note is a written promise to repay a debt.

What are the essential elements of a promissory note template?

+The essential elements of a promissory note template include the parties' names and addresses, the loan amount and interest rate, the repayment terms, and any collateral or security interests.

How often should I review and update the promissory note template?

+You should review and update the promissory note template regularly to ensure it remains compliant with changing laws and regulations.

By following these tips and avoiding common mistakes, you can create an effective and comprehensive Alabama promissory note template that protects both parties and ensures a smooth transaction.