Securing a loan can be a daunting task, especially when it involves significant amounts of money. A promissory note is a vital document that outlines the terms and conditions of a loan, ensuring that both the borrower and lender are on the same page. In Connecticut, a promissory note template can help facilitate the lending process, providing a clear and comprehensive agreement that protects the interests of both parties.

What is a Promissory Note?

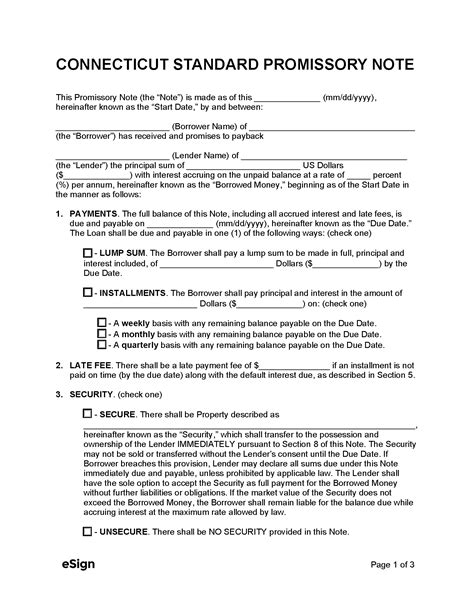

A promissory note is a legally binding document that outlines the terms and conditions of a loan. It is a promise by the borrower to repay the loan, along with any interest or fees, to the lender. A promissory note typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral or security.

Key Components of a Promissory Note

When creating a promissory note in Connecticut, it is essential to include the following key components:

- Loan amount: The total amount borrowed by the borrower.

- Interest rate: The percentage rate at which interest is charged on the loan.

- Repayment schedule: The frequency and amount of payments to be made by the borrower.

- Collateral or security: Any assets or property used to secure the loan.

- Default provisions: The consequences of defaulting on the loan, including late fees and acceleration of payment.

Benefits of Using a Promissory Note Template

Using a promissory note template in Connecticut can provide several benefits, including:

- Clear communication: A promissory note template ensures that both parties understand the terms and conditions of the loan.

- Protection of interests: A promissory note template provides a clear outline of the loan agreement, protecting the interests of both the borrower and lender.

- Time-saving: A promissory note template can save time and effort, as it provides a pre-drafted document that can be easily customized.

- Compliance with laws: A promissory note template can help ensure compliance with Connecticut laws and regulations.

How to Create a Promissory Note in Connecticut

Creating a promissory note in Connecticut can be a straightforward process. Here are the steps to follow:

- Determine the loan amount: Decide on the amount of money to be borrowed.

- Set the interest rate: Determine the interest rate to be charged on the loan.

- Establish the repayment schedule: Decide on the frequency and amount of payments to be made.

- Identify collateral or security: Determine if any assets or property will be used to secure the loan.

- Include default provisions: Outline the consequences of defaulting on the loan.

- Customize the promissory note template: Use a promissory note template and customize it according to the agreed-upon terms.

Best Practices for Lenders and Borrowers

When using a promissory note in Connecticut, it is essential to follow best practices to ensure a smooth and successful lending process. Here are some tips for lenders and borrowers:

- Clearly outline the terms and conditions: Ensure that the promissory note template is clear and comprehensive.

- Use a promissory note template: Use a pre-drafted promissory note template to save time and effort.

- Keep accurate records: Keep accurate records of the loan, including payments and communication.

- Communicate effectively: Communicate clearly and effectively with the borrower or lender.

Common Mistakes to Avoid

When creating a promissory note in Connecticut, it is essential to avoid common mistakes that can lead to disputes or complications. Here are some mistakes to avoid:

- Unclear terms and conditions: Failing to clearly outline the terms and conditions of the loan.

- Insufficient collateral or security: Failing to secure the loan with sufficient collateral or assets.

- Inadequate default provisions: Failing to outline the consequences of defaulting on the loan.

- Poor record-keeping: Failing to keep accurate records of the loan.

Conclusion

A promissory note is a vital document that outlines the terms and conditions of a loan. In Connecticut, a promissory note template can help facilitate the lending process, providing a clear and comprehensive agreement that protects the interests of both parties. By following best practices and avoiding common mistakes, lenders and borrowers can ensure a smooth and successful lending process.

We hope this article has provided valuable insights into creating a promissory note in Connecticut. If you have any further questions or would like to share your experiences, please comment below.

What is a promissory note?

+A promissory note is a legally binding document that outlines the terms and conditions of a loan.

What are the key components of a promissory note?

+The key components of a promissory note include the loan amount, interest rate, repayment schedule, collateral or security, and default provisions.

Why is a promissory note template important?

+A promissory note template is important because it provides a clear and comprehensive agreement that protects the interests of both parties.