A promissory note is a legally binding document that outlines the terms of a loan between two parties. It is a crucial document that ensures the borrower understands their obligations and the lender has a clear record of the loan. In this article, we will discuss the importance of a promissory note, its key components, and provide a template that you can download for free from Google Docs.

What is a Promissory Note?

A promissory note is a written agreement between a lender and a borrower that outlines the terms of a loan. It is a promise by the borrower to repay the loan, including the principal amount, interest, and any fees, according to the agreed-upon terms. The promissory note serves as a legally binding contract between the parties and can be used in various situations, such as personal loans, business loans, and real estate transactions.

Key Components of a Promissory Note

A promissory note typically includes the following key components:

- Parties involved: The names and addresses of the lender and borrower.

- Loan amount: The principal amount of the loan.

- Interest rate: The interest rate charged on the loan.

- Repayment terms: The schedule for repaying the loan, including the payment amount, frequency, and duration.

- Default provisions: The consequences of failing to repay the loan, such as late fees and penalties.

- Security: Any collateral or security provided by the borrower to secure the loan.

Benefits of a Promissory Note

A promissory note provides several benefits to both lenders and borrowers:

- Clear understanding: It ensures that both parties understand the terms of the loan, including the repayment schedule and any interest charges.

- Legally binding: It serves as a legally binding contract, providing a clear record of the loan and protecting the interests of both parties.

- Reduced risk: It reduces the risk of disputes and misunderstandings, as the terms of the loan are clearly outlined.

- Increased credibility: It demonstrates the borrower's commitment to repaying the loan, which can enhance their creditworthiness.

How to Create a Promissory Note

Creating a promissory note is a straightforward process. Here are the steps to follow:

- Define the parties involved: Identify the lender and borrower, including their names and addresses.

- Specify the loan amount: Determine the principal amount of the loan.

- Set the interest rate: Agree on the interest rate charged on the loan.

- Establish the repayment terms: Determine the schedule for repaying the loan, including the payment amount, frequency, and duration.

- Include default provisions: Outline the consequences of failing to repay the loan, such as late fees and penalties.

- Add security: Specify any collateral or security provided by the borrower to secure the loan.

- Sign and date: Sign and date the promissory note, making it a legally binding contract.

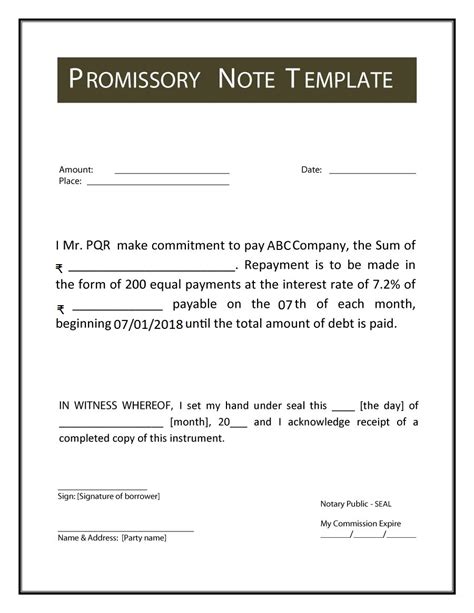

Promissory Note Template Free Download

To help you create a promissory note, we have provided a free template that you can download from Google Docs. This template includes all the necessary components, and you can customize it to suit your specific needs.

- Download the template: Click on the link to download the promissory note template from Google Docs.

- Customize the template: Fill in the necessary information, including the parties involved, loan amount, interest rate, and repayment terms.

- Sign and date: Sign and date the promissory note, making it a legally binding contract.

Conclusion

A promissory note is a crucial document that outlines the terms of a loan between two parties. It provides a clear understanding of the loan, including the repayment schedule and any interest charges. By using a promissory note template, you can create a legally binding contract that protects the interests of both parties. Download our free promissory note template from Google Docs and customize it to suit your specific needs.

We encourage you to share your thoughts and experiences with promissory notes in the comments section below.

What is a promissory note?

+A promissory note is a written agreement between a lender and a borrower that outlines the terms of a loan.

What are the key components of a promissory note?

+The key components of a promissory note include the parties involved, loan amount, interest rate, repayment terms, default provisions, and security.

Why is a promissory note important?

+A promissory note provides a clear understanding of the loan, including the repayment schedule and any interest charges. It also serves as a legally binding contract, protecting the interests of both parties.