Minnesota is known for its stunning natural beauty, vibrant culture, and thriving economy. As a hub for businesses and individuals alike, it's no surprise that Minnesota sees its fair share of financial transactions. When it comes to lending and borrowing money, having a solid understanding of the Minnesota promissory note template is essential. In this comprehensive guide, we'll delve into the world of promissory notes, exploring what they are, why they're important, and how to use the Minnesota promissory note template effectively.

What is a Promissory Note?

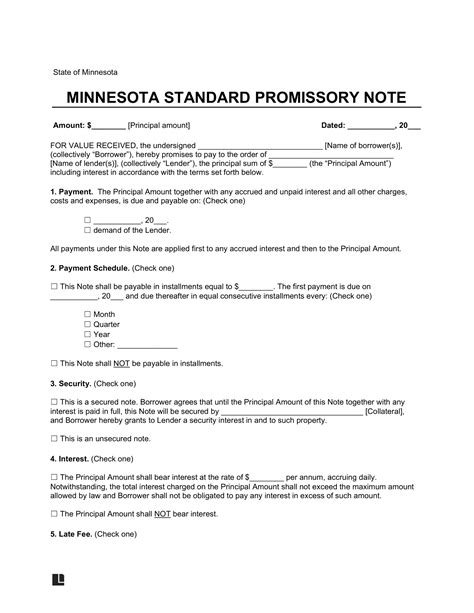

A promissory note is a legally binding document that outlines the terms of a loan between two parties: the borrower and the lender. It's essentially a written promise to repay a debt, typically with interest, by a specific date or over a set period. Promissory notes can be used for various purposes, such as personal loans, business loans, or real estate transactions.

Key Elements of a Promissory Note

A standard promissory note template typically includes the following essential elements:

- Date and Parties Involved: The date the note is signed, the names and addresses of the borrower and lender, and their respective roles in the agreement.

- Loan Amount and Interest Rate: The total amount borrowed, the interest rate, and how interest will be calculated and paid.

- Repayment Terms: The repayment schedule, including the frequency of payments, the amount of each payment, and the due date for each payment.

- Default Provisions: The consequences of failing to make payments on time, such as late fees or acceleration of the debt.

- Security: Any collateral or security provided to guarantee the loan.

Why Use a Minnesota Promissory Note Template?

Using a Minnesota promissory note template offers several benefits, including:

- Clear and Concise Agreement: A template helps ensure that all necessary details are included, avoiding misunderstandings and disputes.

- Minnesota State-Specific Requirements: The template is tailored to meet Minnesota state laws and regulations, ensuring compliance and minimizing potential issues.

- Professionalism and Credibility: A well-structured promissory note template demonstrates professionalism and credibility, helping to build trust between the parties involved.

How to Use the Minnesota Promissory Note Template

To use the Minnesota promissory note template effectively, follow these steps:

- Download and Review the Template: Obtain a Minnesota promissory note template and review its contents to ensure it meets your needs.

- Fill in the Required Information: Carefully fill in the required information, including the date, parties involved, loan amount, interest rate, and repayment terms.

- Customize the Template: Modify the template as necessary to fit your specific situation.

- Sign and Date the Document: Both the borrower and lender must sign and date the document to make it legally binding.

Additional Tips and Considerations

When using a Minnesota promissory note template, keep the following tips and considerations in mind:

- Seek Professional Advice: Consult with a lawyer or financial advisor to ensure the template meets your specific needs and complies with Minnesota state laws.

- Use Clear and Concise Language: Avoid using ambiguous language or technical jargon that may be difficult to understand.

- Keep Records: Maintain accurate records of all payments, communications, and agreements related to the loan.

Minnesota Promissory Note Template FAQs

Here are some frequently asked questions about using a Minnesota promissory note template:

- Q: What is the statute of limitations for collecting a debt in Minnesota? A: The statute of limitations for collecting a debt in Minnesota is six years.

- Q: Can I use a promissory note for personal loans? A: Yes, promissory notes can be used for personal loans, such as lending money to friends or family members.

- Q: Do I need to notarize a promissory note in Minnesota? A: No, notarization is not required for a promissory note in Minnesota, but it's recommended to have a witness sign the document.

What is the purpose of a promissory note?

+A promissory note is a legally binding document that outlines the terms of a loan between two parties, including the loan amount, interest rate, and repayment terms.

How do I fill out a Minnesota promissory note template?

+Fill in the required information, including the date, parties involved, loan amount, interest rate, and repayment terms. Customize the template as necessary to fit your specific situation.

What are the consequences of defaulting on a promissory note in Minnesota?

+Defaulting on a promissory note in Minnesota can result in late fees, acceleration of the debt, and potential lawsuits. It's essential to communicate with the lender and seek professional advice if you're having trouble making payments.

In conclusion, using a Minnesota promissory note template is a great way to ensure a clear and concise agreement between borrowers and lenders. By understanding the key elements of a promissory note and following the tips and considerations outlined in this guide, you'll be well-equipped to navigate the world of lending and borrowing in Minnesota.