A promissory note is a legally binding document that outlines the terms of a loan, including the amount borrowed, interest rate, and repayment terms. In Missouri, a promissory note is a common way for individuals and businesses to formalize loan agreements. If you're looking for a Missouri promissory note template, you can download a free template online or create your own using a word processing software.

Importance of a Promissory Note

A promissory note serves several purposes:

- Clarifies loan terms: A promissory note clearly outlines the terms of the loan, including the amount borrowed, interest rate, and repayment terms.

- Provides a paper trail: A promissory note provides a written record of the loan agreement, which can help prevent misunderstandings or disputes.

- Establishes a payment schedule: A promissory note outlines the payment schedule, including the amount and frequency of payments.

- Protects lenders: A promissory note provides lenders with a binding contract that can be enforced in court if the borrower defaults on the loan.

Missouri Promissory Note Template Free Download

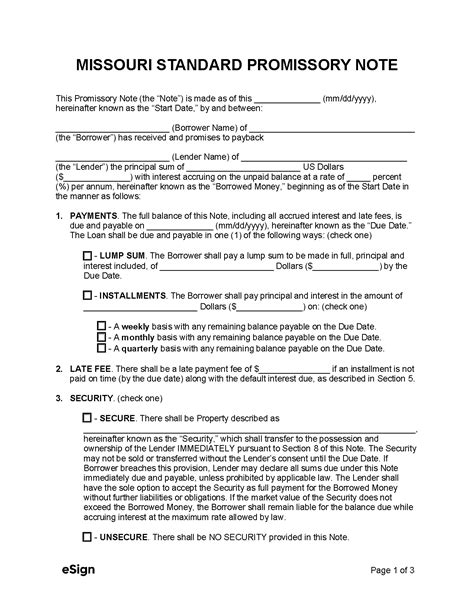

You can download a free Missouri promissory note template online or create your own using a word processing software. Here's a sample template:

[Insert image: Missouri Promissory Note Template]

This template includes the following sections:

- Loan details: This section outlines the amount borrowed, interest rate, and repayment terms.

- Borrower information: This section includes the borrower's name, address, and contact information.

- Lender information: This section includes the lender's name, address, and contact information.

- Payment schedule: This section outlines the payment schedule, including the amount and frequency of payments.

- Default and acceleration: This section outlines the consequences of defaulting on the loan, including acceleration of the loan.

- Governing law: This section specifies the laws that govern the loan agreement.

Using a Missouri Promissory Note Template

When using a Missouri promissory note template, make sure to:

- Fill in the blanks: Fill in the blanks with the relevant information, including the loan amount, interest rate, and repayment terms.

- Review the terms: Review the terms of the loan agreement to ensure that they are fair and reasonable.

- Sign the document: Sign the document in the presence of a notary public, if required.

- Keep a copy: Keep a copy of the signed document for your records.

Benefits of Using a Missouri Promissory Note Template

Using a Missouri promissory note template offers several benefits:

- Saves time: A promissory note template saves time and effort in creating a loan agreement from scratch.

- Provides a clear understanding: A promissory note template provides a clear understanding of the loan terms and repayment schedule.

- Reduces misunderstandings: A promissory note template reduces misunderstandings and disputes by providing a written record of the loan agreement.

- Protects lenders: A promissory note template protects lenders by providing a binding contract that can be enforced in court if the borrower defaults on the loan.

FAQs

Q: What is a promissory note? A: A promissory note is a legally binding document that outlines the terms of a loan, including the amount borrowed, interest rate, and repayment terms.

Q: Why do I need a promissory note? A: A promissory note provides a written record of the loan agreement, which can help prevent misunderstandings or disputes.

Q: Can I use a promissory note template for a personal loan? A: Yes, you can use a promissory note template for a personal loan. However, make sure to review the terms and conditions carefully to ensure that they are fair and reasonable.

Q: Do I need to sign the promissory note in the presence of a notary public? A: It depends on the laws of your state. In Missouri, it is recommended to sign the promissory note in the presence of a notary public to ensure that the document is valid and enforceable.

Conclusion

A Missouri promissory note template is a useful tool for individuals and businesses looking to formalize loan agreements. By using a promissory note template, you can save time and effort in creating a loan agreement from scratch, provide a clear understanding of the loan terms and repayment schedule, reduce misunderstandings and disputes, and protect lenders. Remember to review the terms and conditions carefully and sign the document in the presence of a notary public, if required.