A promissory note is a written agreement where one party, known as the borrower or maker, promises to pay a certain amount of money to another party, known as the lender or payee. In New Jersey, a promissory note is a common legal instrument used in various transactions, such as loans, mortgages, and business deals. Having a well-drafted promissory note template is essential to ensure secure transactions and protect the interests of all parties involved.

In this article, we will explore the importance of promissory notes, the key elements of a New Jersey promissory note template, and provide a sample template for secure transactions.

Why Use a Promissory Note?

A promissory note serves as a written record of a debt obligation between two parties. It outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment terms, and any collateral or security required. By using a promissory note, parties can ensure that their agreement is clear, concise, and binding.

Key Elements of a New Jersey Promissory Note Template

A well-drafted promissory note template should include the following essential elements:

- Identification of Parties: The note should clearly identify the borrower (maker) and the lender (payee), including their names, addresses, and contact information.

- Loan Amount: The note should specify the principal amount borrowed, including the interest rate and any fees associated with the loan.

- Repayment Terms: The note should outline the repayment terms, including the payment schedule, due dates, and any late payment fees.

- Interest Rate: The note should specify the interest rate, including any compounding interest or penalties for late payments.

- Collateral or Security: If the loan is secured by collateral or security, the note should describe the collateral, including its value and any terms related to its disposal.

- Default Provisions: The note should outline the consequences of default, including any acceleration of payments, late fees, or other penalties.

- Governing Law: The note should specify the governing law of the agreement, including the state and jurisdiction.

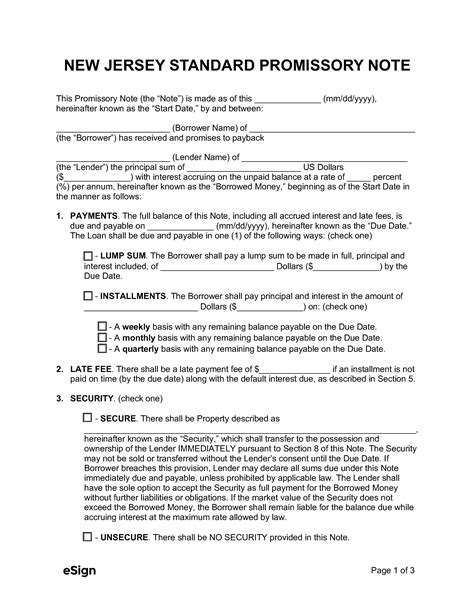

Sample New Jersey Promissory Note Template

Below is a sample promissory note template for secure transactions in New Jersey:

NEW JERSEY PROMISSORY NOTE

This Promissory Note ("Note") is made and entered into on [DATE] ("Effective Date") by and between [BORROWER'S NAME] ("Borrower") with a principal place of business at [BORROWER'S ADDRESS] and [LENDER'S NAME] ("Lender") with a principal place of business at [LENDER'S ADDRESS].

1. Loan Amount

The Borrower promises to pay to the Lender the principal sum of $[LOAN AMOUNT] ("Loan Amount") plus interest as described below.

2. Interest Rate

The Loan Amount shall bear interest at a rate of [INTEREST RATE]% per annum, compounded annually.

3. Repayment Terms

The Borrower shall repay the Loan Amount, plus interest, in accordance with the following repayment schedule:

- [NUMBER] payments of $[PAYMENT AMOUNT] each, due on the [DUE DATE] day of each [MONTH] month, commencing on [FIRST PAYMENT DATE] and ending on [FINAL PAYMENT DATE].

4. Collateral or Security

This Note is secured by [COLLATERAL DESCRIPTION], which shall be held by the Lender as security for the Loan Amount.

5. Default Provisions

If the Borrower fails to make any payment when due, the Lender may declare the entire Loan Amount, plus interest, immediately due and payable.

6. Governing Law

This Note shall be governed by and construed in accordance with the laws of the State of New Jersey.

By signing below, the parties acknowledge that they have read, understand, and agree to the terms and conditions of this Note.

BORROWER

[BORROWER'S SIGNATURE]

LENDER

[LENDER'S SIGNATURE]

Gallery of Promissory Note Templates

FAQs

What is a promissory note?

+A promissory note is a written agreement where one party promises to pay a certain amount of money to another party.

What are the key elements of a promissory note?

+The key elements of a promissory note include the identification of parties, loan amount, interest rate, repayment terms, collateral or security, default provisions, and governing law.

Why is it important to use a promissory note template?

+Using a promissory note template ensures that the agreement is clear, concise, and binding, protecting the interests of all parties involved.

We hope this article has provided you with a comprehensive understanding of promissory notes and their importance in secure transactions. By using a well-drafted promissory note template, you can ensure that your agreements are clear, concise, and binding. If you have any questions or need further assistance, please do not hesitate to contact us.