Creating a church budget template is an essential step in managing the financial resources of your church. A well-structured budget template helps you track income and expenses, make informed financial decisions, and ensure the long-term sustainability of your church. In this article, we will guide you through the 7 essential steps to create a comprehensive church budget template.

Churches rely heavily on donations, tithes, and offerings to fund their operations, community programs, and charitable activities. Without a clear budget, it's challenging to allocate resources effectively, prioritize spending, and make strategic decisions about the church's future. A church budget template helps you organize your financial data, identify areas for cost savings, and make data-driven decisions to drive growth and ministry.

Step 1: Identify Your Church's Financial Goals and Objectives

Before creating a budget template, it's crucial to define your church's financial goals and objectives. Consider the following:

- What are your church's short-term and long-term financial goals?

- What are your priorities for spending and resource allocation?

- How do you plan to measure financial success and progress?

Some common financial goals for churches include:

- Increasing giving and donations

- Reducing debt and improving cash flow

- Funding new programs and initiatives

- Improving financial transparency and accountability

Step 2: Gather Financial Data and Information

To create an accurate and comprehensive budget template, you need to gather relevant financial data and information. This includes:

- Historical financial statements (income statements, balance sheets, etc.)

- Current financial reports and ledgers

- Donor and member giving data

- Expense records and invoices

- Information about church assets, liabilities, and investments

Reviewing your church's financial history and current financial situation will help you identify trends, patterns, and areas for improvement.

Step 3: Categorize Expenses and Income

A church budget template typically includes several categories for expenses and income. Common categories include:

- Personnel expenses (salaries, benefits, etc.)

- Program expenses (missions, outreach, etc.)

- Administrative expenses (office supplies, utilities, etc.)

- Capital expenses (building maintenance, etc.)

- Giving and donations

- Tithes and offerings

- Grants and funding

Consider using a standard chart of accounts to categorize your expenses and income.

Step 4: Establish Budget Line Items and Amounts

Using your financial data and categorized expenses and income, establish budget line items and amounts for each category. Consider the following:

- Historical spending patterns and trends

- Current financial needs and priorities

- Future plans and initiatives

- Inflation and cost increases

Be sure to include a contingency fund for unexpected expenses and emergencies.

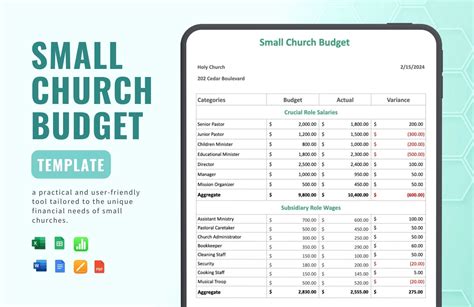

Step 5: Create a Budget Template and Format

Using your budget line items and amounts, create a budget template and format that is easy to understand and use. Consider the following:

- Use a spreadsheet software like Excel or Google Sheets

- Create separate sheets for income, expenses, and budget summaries

- Use formulas and equations to calculate totals and percentages

- Include charts and graphs to visualize financial data

Step 6: Review and Revise the Budget Template

Before finalizing your budget template, review and revise it carefully. Consider the following:

- Review historical financial data and current financial trends

- Consider feedback from church leaders, staff, and members

- Revise budget line items and amounts as needed

- Ensure the budget template is accurate, comprehensive, and easy to use

Step 7: Implement and Monitor the Budget Template

Once you have finalized your budget template, implement it and monitor it regularly. Consider the following:

- Use the budget template to track income and expenses

- Review financial reports and statements regularly

- Make adjustments to the budget template as needed

- Ensure financial transparency and accountability

We hope this article has provided you with a comprehensive guide to creating a church budget template. By following these 7 essential steps, you can create a budget template that helps you manage your church's finances effectively, make informed decisions, and achieve your financial goals.

What is a church budget template?

+A church budget template is a document that outlines projected income and expenses for a church over a specific period, typically a year.

Why is a church budget template important?

+A church budget template helps churches manage their finances effectively, make informed decisions, and achieve their financial goals.

What are the key components of a church budget template?

+The key components of a church budget template include income, expenses, budget line items, and financial reports.

If you have any further questions or need help creating a church budget template, please don't hesitate to contact us. We're here to help.