Creating a Discounted Cash Flow (DCF) Excel template can be a daunting task, especially for those without extensive financial modeling experience. However, with a clear understanding of the DCF concept and a step-by-step guide, you can create a comprehensive and accurate DCF Excel template. In this article, we will walk you through the 7 simple steps to create a DCF Excel template.

Understanding DCF

Before diving into the steps, let's quickly review the concept of DCF. DCF is a valuation method used to estimate the present value of future cash flows. It's widely used in finance to evaluate investment opportunities, mergers, and acquisitions. The basic idea is to forecast future cash flows, discount them to their present value, and then sum them up to get the total present value.

Step 1: Set up the Template Structure

To create a DCF Excel template, start by setting up the template structure. Open a new Excel workbook and create the following sheets:

- Input: This sheet will contain the input data for the DCF model, such as revenue growth rates, profit margins, and discount rates.

- Assumptions: This sheet will outline the assumptions made for the DCF model, such as the forecast period and the growth rates.

- Forecast: This sheet will contain the forecasted financial statements, including income statements and cash flow statements.

- DCF: This sheet will calculate the present value of the forecasted cash flows.

- Output: This sheet will display the results of the DCF model, including the estimated present value and the terminal value.

Step 2: Input Historical Data

In the Input sheet, enter the historical financial data for the company, including revenue, net income, and cash flow. This data will be used to estimate the future growth rates and profit margins.

- Revenue: Enter the historical revenue data for the company.

- Net Income: Enter the historical net income data for the company.

- Cash Flow: Enter the historical cash flow data for the company.

Step 3: Estimate Growth Rates and Profit Margins

In the Assumptions sheet, estimate the future growth rates and profit margins based on the historical data.

- Revenue Growth Rate: Estimate the future revenue growth rate based on the historical data.

- Net Income Margin: Estimate the future net income margin based on the historical data.

- Cash Flow Margin: Estimate the future cash flow margin based on the historical data.

Step 4: Forecast Financial Statements

In the Forecast sheet, create forecasted financial statements, including income statements and cash flow statements, based on the estimated growth rates and profit margins.

- Revenue: Forecast the future revenue based on the estimated growth rate.

- Net Income: Forecast the future net income based on the estimated net income margin.

- Cash Flow: Forecast the future cash flow based on the estimated cash flow margin.

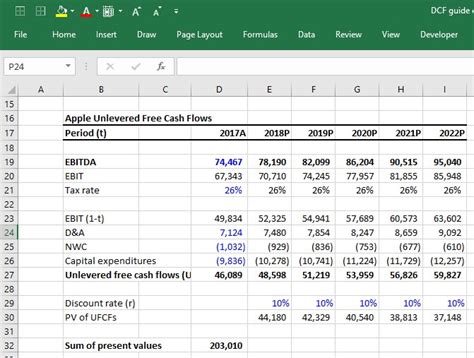

Step 5: Calculate Present Value

In the DCF sheet, calculate the present value of the forecasted cash flows using the estimated discount rate.

- Discount Rate: Enter the estimated discount rate.

- Present Value: Calculate the present value of the forecasted cash flows using the discount rate.

Step 6: Calculate Terminal Value

In the DCF sheet, calculate the terminal value of the company using the estimated perpetuity growth rate and the present value of the forecasted cash flows.

- Perpetuity Growth Rate: Enter the estimated perpetuity growth rate.

- Terminal Value: Calculate the terminal value using the perpetuity growth rate and the present value of the forecasted cash flows.

Step 7: Display Results

In the Output sheet, display the results of the DCF model, including the estimated present value and the terminal value.

- Present Value: Display the estimated present value.

- Terminal Value: Display the estimated terminal value.

By following these 7 simple steps, you can create a comprehensive and accurate DCF Excel template to estimate the present value of future cash flows.

Gallery of DCF Template Examples

FAQ

What is DCF?

+DCF stands for Discounted Cash Flow, which is a valuation method used to estimate the present value of future cash flows.

How do I create a DCF template?

+You can create a DCF template by following the 7 simple steps outlined in this article.

What is the purpose of the DCF template?

+The purpose of the DCF template is to estimate the present value of future cash flows and determine the value of a company or investment.

We hope this article has provided you with a comprehensive guide on how to create a DCF Excel template. If you have any further questions or need assistance, please don't hesitate to contact us.