In the vast and thriving state of Texas, with its diverse industries and workforce, it's crucial for employers to maintain accurate and detailed records of their employees' wages. This is where Texas pay stub templates come into play. These templates serve as a guide to ensure compliance with state regulations, providing both employers and employees with a clear understanding of salary components, deductions, and overall compensation.

Pay stubs are more than just a receipt for employees; they're a vital tool for tracking employment income, taxes, and benefits. In Texas, like in many states, there are specific requirements for the information that must be included in a pay stub. Employers who fail to provide compliant pay stubs can face penalties, making it essential to utilize accurate and comprehensive templates.

The Importance of Texas Pay Stub Templates

Texas pay stub templates are designed to simplify the process of creating pay stubs that meet the state's regulations. These templates ensure that employers include all necessary information, reducing the risk of errors or omissions. By using a Texas pay stub template, employers can save time and resources, focusing instead on managing their business and ensuring employee satisfaction.

Key Components of Texas Pay Stub Templates

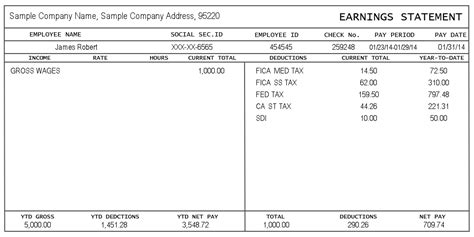

A standard Texas pay stub template should include the following essential components:

- Employee Information: The employee's name, address, and social security number or employee ID number.

- Pay Period and Date: The pay period start and end dates, along with the date the pay stub is issued.

- Earnings: A breakdown of the employee's earnings, including regular hours worked, overtime hours, and the respective rates of pay.

- Deductions: A detailed list of deductions made from the employee's earnings, such as taxes, health insurance, and retirement contributions.

- Net Pay: The employee's net pay, which is the amount they take home after all deductions have been subtracted.

5 Essential Texas Pay Stub Templates

1. Basic Texas Pay Stub Template

The basic Texas pay stub template is ideal for small businesses or those with straightforward payroll needs. It includes the minimum required information, making it easy to use and understand.

2. Detailed Texas Pay Stub Template with Benefits

For employers who offer various benefits to their employees, such as health insurance, retirement plans, or education assistance, a detailed Texas pay stub template is necessary. This template allows for the inclusion of these benefits and their associated deductions.

3. Texas Pay Stub Template for Overtime

Employees who work overtime require a pay stub that accurately reflects their additional hours and pay rate. The Texas pay stub template for overtime is designed to handle these calculations, ensuring compliance with overtime regulations.

4. Texas Pay Stub Template for Contractors

Contractors and freelancers have different payroll needs than traditional employees. The Texas pay stub template for contractors is tailored to meet these unique requirements, including space for invoicing and payment details.

5. Electronic Texas Pay Stub Template

In today's digital age, many employers prefer electronic pay stubs for their convenience and environmental benefits. The electronic Texas pay stub template is designed to be easily accessible and downloadable, meeting the state's requirements for electronic pay stubs.

Gallery of Texas Pay Stub Templates

FAQ Section

What information must be included in a Texas pay stub?

+A Texas pay stub must include the employee's name, address, and social security number or employee ID number, pay period and date, earnings, deductions, and net pay.

Can I use a generic pay stub template for my Texas employees?

+No, Texas has specific requirements for pay stubs. Using a generic template may not meet these requirements, potentially leading to compliance issues.

How often must I provide pay stubs to my Texas employees?

+Employers in Texas must provide pay stubs to their employees at the time of payment, which is typically on the designated payday.

If you're looking to streamline your payroll process while ensuring compliance with Texas regulations, utilizing a Texas pay stub template is an efficient and effective solution. Whether you're managing a small startup or a large corporation, these templates cater to various payroll needs, from basic to complex scenarios. By incorporating one of these templates into your payroll system, you'll be well on your way to maintaining accurate, transparent, and compliant pay stubs for your Texas employees.