Truck drivers play a crucial role in the logistics and transportation industry, ensuring that goods are delivered safely and efficiently across the country. To manage their finances effectively, truck drivers need to keep track of their pay stubs, which provide a detailed breakdown of their earnings, deductions, and taxes. In this article, we will explore the importance of truck driver pay stubs, provide a template example, and offer a comprehensive guide on how to create and use them.

Why Are Truck Driver Pay Stubs Important?

Truck driver pay stubs are essential for several reasons:

- Accurate Record-Keeping: Pay stubs help truck drivers keep a record of their earnings, which is necessary for tax purposes, financial planning, and budgeting.

- Transparency: Pay stubs provide a clear breakdown of earnings, deductions, and taxes, ensuring that truck drivers understand how their pay is calculated.

- Compliance: Pay stubs help employers comply with labor laws and regulations, such as the Fair Labor Standards Act (FLSA).

- Financial Planning: Pay stubs enable truck drivers to plan their finances, make informed decisions about their money, and avoid financial difficulties.

Truck Driver Pay Stub Template Example

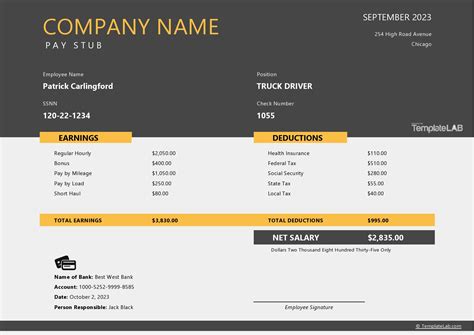

Here is a basic template example of a truck driver pay stub:

[Company Logo]

[Company Name] [Address] [City, State, ZIP] [Date]

Pay Stub for [Truck Driver's Name]

Pay Period: [Pay Period Dates] Pay Date: [Pay Date]

Earnings:

- Gross Pay: $ [Gross Pay Amount]

- Hours Worked: [Number of Hours Worked]

- Hourly Rate: $ [Hourly Rate]

Deductions:

- Federal Income Tax: $ [Federal Income Tax Amount]

- State Income Tax: $ [State Income Tax Amount]

- Social Security Tax: $ [Social Security Tax Amount]

- Medicare Tax: $ [Medicare Tax Amount]

- Other Deductions: $ [Other Deductions Amount]

Net Pay: $ [Net Pay Amount]

Year-to-Date (YTD) Information:

- Gross Pay YTD: $ [Gross Pay YTD Amount]

- Federal Income Tax YTD: $ [Federal Income Tax YTD Amount]

- State Income Tax YTD: $ [State Income Tax YTD Amount]

[Company Name]

Note: This is a basic template example, and actual pay stubs may vary depending on the company and the truck driver's specific situation.

How to Create a Truck Driver Pay Stub

To create a truck driver pay stub, follow these steps:

- Gather Information: Collect the necessary information, including the truck driver's name, pay period dates, pay date, gross pay, hours worked, hourly rate, deductions, and net pay.

- Choose a Template: Use a pay stub template or create one from scratch using a spreadsheet or word processing software.

- Enter Information: Enter the gathered information into the template, ensuring accuracy and attention to detail.

- Calculate Deductions: Calculate the deductions, including federal income tax, state income tax, social security tax, medicare tax, and other deductions.

- Calculate Net Pay: Calculate the net pay by subtracting the total deductions from the gross pay.

- Review and Verify: Review and verify the pay stub for accuracy and completeness.

Tips for Using Truck Driver Pay Stubs

Here are some tips for using truck driver pay stubs effectively:

- Keep Accurate Records: Keep accurate and up-to-date records of pay stubs, including electronic copies and paper backups.

- Review Regularly: Review pay stubs regularly to ensure accuracy and detect any errors or discrepancies.

- Use for Financial Planning: Use pay stubs to plan finances, make informed decisions about money, and avoid financial difficulties.

- Comply with Labor Laws: Use pay stubs to comply with labor laws and regulations, such as the FLSA.

Gallery of Truck Driver Pay Stub Templates

Frequently Asked Questions

What is a truck driver pay stub?

+A truck driver pay stub is a document that shows a truck driver's earnings, deductions, and net pay for a specific pay period.

Why is a truck driver pay stub important?

+A truck driver pay stub is important for accurate record-keeping, transparency, compliance with labor laws, and financial planning.

How do I create a truck driver pay stub?

+To create a truck driver pay stub, gather the necessary information, choose a template, enter the information, calculate deductions and net pay, and review and verify the pay stub.

We hope this article has provided valuable insights into the importance of truck driver pay stubs, how to create them, and how to use them effectively. By following the tips and guidelines outlined in this article, truck drivers and employers can ensure accurate record-keeping, transparency, and compliance with labor laws.