Truck drivers and owner-operators are the backbone of the logistics industry, responsible for transporting goods and commodities across the country. To ensure their business remains profitable, it's essential to keep track of expenses, revenue, and other financial metrics. A truck driver profit loss statement template is a valuable tool for achieving this goal.

In this article, we'll explore the importance of a profit loss statement for truck drivers, provide a template, and discuss how to use it effectively.

Why is a Profit Loss Statement Important for Truck Drivers?

A profit loss statement, also known as an income statement, is a financial document that summarizes a business's revenues and expenses over a specific period. For truck drivers, a profit loss statement is crucial for several reasons:

- Tracks profitability: By comparing revenue with expenses, truck drivers can determine whether their business is generating a profit or loss.

- Identifies areas for improvement: A profit loss statement helps truck drivers pinpoint areas where they can reduce expenses, increase revenue, or optimize operations.

- Informs business decisions: Accurate financial data enables truck drivers to make informed decisions about investments, pricing, and resource allocation.

- Enhances accountability: A profit loss statement promotes accountability by providing a clear picture of a truck driver's financial performance.

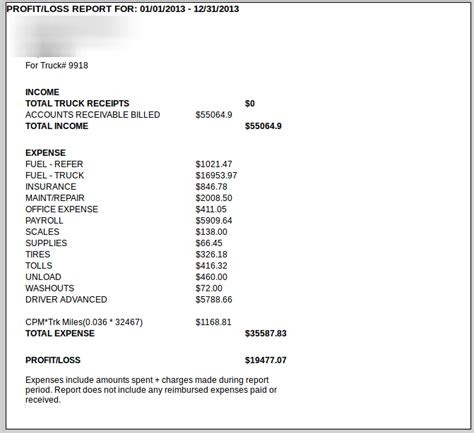

Truck Driver Profit Loss Statement Template

Here is a basic template for a truck driver profit loss statement:

| Revenue | |

|---|---|

| Gross Revenue | |

| ‣ Freight Revenue | |

| ‣ Fuel Surcharge Revenue | |

| ‣ Accessorial Revenue | |

| ‣ Other Revenue | |

| Total Revenue | |

| Cost of Goods Sold | |

| ‣ Fuel Expenses | |

| ‣ Maintenance and Repairs | |

| ‣ Tolls and Fees | |

| ‣ Insurance Premiums | |

| ‣ Other Expenses | |

| Total Cost of Goods Sold | |

| Gross Profit | |

| Operating Expenses | |

| ‣ Salaries and Wages | |

| ‣ Benefits and Payroll Taxes | |

| ‣ Rent and Utilities | |

| ‣ Marketing and Advertising | |

| ‣ Other Operating Expenses | |

| Total Operating Expenses | |

| Operating Income | |

| Non-Operating Income (Expenses) | |

| ‣ Interest Income | |

| ‣ Interest Expenses | |

| ‣ Other Non-Operating Income (Expenses) | |

| Total Non-Operating Income (Expenses) | |

| Net Income |

How to Use the Template

To use the template effectively, follow these steps:

- Track revenue and expenses: Record all revenue and expenses in the respective categories.

- Calculate gross profit: Subtract the total cost of goods sold from the total revenue.

- Calculate operating income: Subtract the total operating expenses from the gross profit.

- Calculate non-operating income (expenses): Record interest income, interest expenses, and other non-operating income (expenses).

- Calculate net income: Add the operating income and non-operating income (expenses) to determine the net income.

Best Practices for Creating a Profit Loss Statement

To ensure accuracy and effectiveness, follow these best practices:

- Use accounting software: Utilize accounting software to streamline financial record-keeping and reduce errors.

- Regularly review financials: Schedule regular reviews of your profit loss statement to identify trends, areas for improvement, and potential issues.

- Categorize expenses: Use clear and concise categories for expenses to facilitate analysis and decision-making.

- Seek professional advice: Consult with an accountant or financial advisor to ensure your profit loss statement is accurate and comprehensive.

Conclusion

A truck driver profit loss statement template is a valuable tool for tracking financial performance, identifying areas for improvement, and informing business decisions. By using the template and following best practices, truck drivers can ensure their business remains profitable and competitive in the logistics industry.

Share your thoughts: How do you use a profit loss statement to manage your trucking business? Share your experiences and tips in the comments below.

Gallery of Truck Driver Profit Loss Statement Templates

FAQ

What is a profit loss statement?

+A profit loss statement is a financial document that summarizes a business's revenues and expenses over a specific period.

Why is a profit loss statement important for truck drivers?

+A profit loss statement helps truck drivers track profitability, identify areas for improvement, inform business decisions, and enhance accountability.

How do I create a profit loss statement for my trucking business?

+Use the provided template, track revenue and expenses, calculate gross profit, operating income, and net income, and review financials regularly.