Effective cash flow management is crucial for the financial health and stability of any business. A weekly cash flow forecast template in Excel can help you stay on top of your finances and make informed decisions. In this article, we will explore the importance of cash flow forecasting, how to create a weekly cash flow forecast template in Excel, and provide tips for using it effectively.

Why is Cash Flow Forecasting Important?

Cash flow forecasting is the process of predicting the inflows and outflows of cash in a business over a specific period. It helps you identify potential cash shortages, make informed decisions about investments and funding, and optimize your financial resources. A weekly cash flow forecast template can help you:

- Identify areas where you can reduce costs and improve profitability

- Make informed decisions about investments and funding

- Optimize your financial resources and reduce the risk of cash shortages

- Improve your relationships with suppliers and customers by managing your cash flow effectively

How to Create a Weekly Cash Flow Forecast Template in Excel

Creating a weekly cash flow forecast template in Excel is a straightforward process. Here's a step-by-step guide:

- Determine the Forecast Period: Decide on the forecast period, which in this case is one week. Identify the start and end dates of the forecast period.

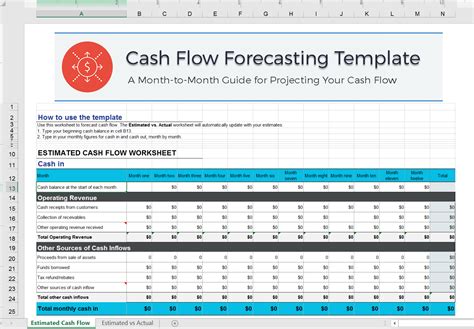

- Set up the Template: Create a new Excel spreadsheet and set up the template with the following columns:

- Date

- Cash Inflows (e.g., sales, accounts receivable, loans)

- Cash Outflows (e.g., accounts payable, salaries, rent)

- Net Cash Flow

- Beginning Balance

- Ending Balance

- Enter Historical Data: Enter historical data for the past few weeks to get a baseline for your forecast. This will help you identify trends and patterns in your cash flow.

- Forecast Cash Inflows: Estimate your cash inflows for each day of the forecast period. Consider factors such as sales, accounts receivable, and loans.

- Forecast Cash Outflows: Estimate your cash outflows for each day of the forecast period. Consider factors such as accounts payable, salaries, rent, and other expenses.

- Calculate Net Cash Flow: Calculate the net cash flow for each day by subtracting the cash outflows from the cash inflows.

- Calculate Beginning and Ending Balances: Calculate the beginning and ending balances for each day by adding the net cash flow to the previous day's balance.

Tips for Using Your Weekly Cash Flow Forecast Template

Here are some tips for using your weekly cash flow forecast template effectively:

- Regularly Update the Template: Regularly update the template with actual data to ensure that your forecast remains accurate.

- Monitor Cash Flow Closely: Monitor your cash flow closely and adjust your forecast as needed.

- Identify Areas for Improvement: Identify areas where you can reduce costs and improve profitability.

- Make Informed Decisions: Use your forecast to make informed decisions about investments and funding.

- Communicate with Stakeholders: Communicate your forecast with stakeholders, such as suppliers and customers, to manage their expectations.

Benefits of Using a Weekly Cash Flow Forecast Template

Using a weekly cash flow forecast template can have numerous benefits for your business, including:

- Improved Cash Flow Management: A weekly cash flow forecast template can help you manage your cash flow more effectively, reducing the risk of cash shortages and improving your relationships with suppliers and customers.

- Increased Profitability: By identifying areas where you can reduce costs and improve profitability, you can increase your bottom line and improve your financial stability.

- Better Decision Making: A weekly cash flow forecast template can provide you with valuable insights into your cash flow, enabling you to make informed decisions about investments and funding.

- Reduced Financial Stress: By having a clear understanding of your cash flow, you can reduce financial stress and improve your overall well-being.

Common Mistakes to Avoid When Creating a Weekly Cash Flow Forecast Template

When creating a weekly cash flow forecast template, there are several common mistakes to avoid, including:

- Not Considering All Cash Flows: Make sure to consider all cash flows, including accounts receivable and payable, loans, and other expenses.

- Not Updating the Template Regularly: Regularly update the template with actual data to ensure that your forecast remains accurate.

- Not Monitoring Cash Flow Closely: Monitor your cash flow closely and adjust your forecast as needed.

- Not Communicating with Stakeholders: Communicate your forecast with stakeholders, such as suppliers and customers, to manage their expectations.

Conclusion

A weekly cash flow forecast template can be a valuable tool for managing your cash flow and making informed decisions. By following the steps outlined in this article, you can create a template that meets your needs and helps you achieve your financial goals. Remember to regularly update the template, monitor your cash flow closely, and communicate with stakeholders to get the most out of your weekly cash flow forecast template.

Gallery of Weekly Cash Flow Forecast Templates

What is a weekly cash flow forecast template?

+A weekly cash flow forecast template is a tool used to predict the inflows and outflows of cash in a business over a specific period, typically one week.

Why is cash flow forecasting important?

+Cash flow forecasting is important because it helps businesses manage their cash flow effectively, reduce the risk of cash shortages, and make informed decisions about investments and funding.

How do I create a weekly cash flow forecast template in Excel?

+To create a weekly cash flow forecast template in Excel, follow the steps outlined in this article, including determining the forecast period, setting up the template, entering historical data, forecasting cash inflows and outflows, and calculating net cash flow.