Rental property investments can be a lucrative venture, but managing the finances effectively is crucial to ensure profitability and long-term success. A well-structured balance sheet template in Excel can help rental property owners and managers keep track of their assets, liabilities, and equity. In this article, we will discuss the importance of a balance sheet, its components, and provide a comprehensive template in Excel.

Why is a Balance Sheet Important for Rental Properties?

A balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. For rental properties, a balance sheet is essential to:

- Track assets: Rental properties, equipment, and other assets can be listed on the balance sheet to ensure accurate accounting and depreciation.

- Manage liabilities: Loans, mortgages, and other debts can be tracked, and their impact on cash flow can be analyzed.

- Monitor equity: Owner's equity, including retained earnings and dividends, can be calculated to evaluate the overall financial health of the rental property business.

Components of a Balance Sheet

A balance sheet typically consists of three main sections:

- Assets: These are resources owned or controlled by the rental property business, such as:

- Rental properties

- Cash and bank accounts

- Accounts receivable (rental income)

- Equipment and fixtures

- Prepaid expenses (insurance, taxes, etc.)

- Liabilities: These are debts or obligations that the rental property business owes to others, such as:

- Loans and mortgages

- Accounts payable (expenses, utilities, etc.)

- Accrued expenses (wages, taxes, etc.)

- Equity: This represents the ownership interest in the rental property business, including:

- Owner's capital

- Retained earnings

- Dividends

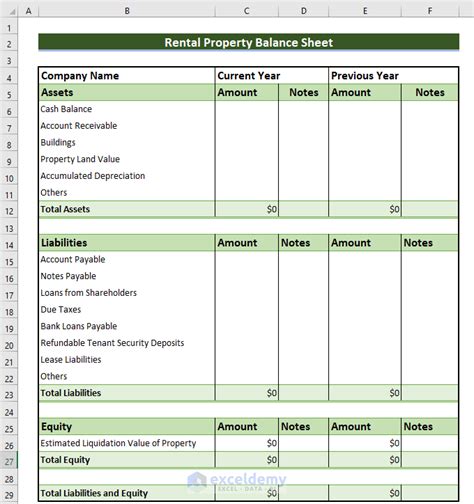

Rental Property Balance Sheet Template in Excel

Here is a basic template to help you create a balance sheet for your rental property business in Excel:

Assets

| Asset | Account | Value |

|---|---|---|

| Rental Properties | 1000 | $500,000 |

| Cash and Bank Accounts | 1100 | $100,000 |

| Accounts Receivable | 1200 | $50,000 |

| Equipment and Fixtures | 1300 | $20,000 |

| Prepaid Expenses | 1400 | $10,000 |

Liabilities

| Liability | Account | Value |

|---|---|---|

| Loans and Mortgages | 2000 | $300,000 |

| Accounts Payable | 2100 | $20,000 |

| Accrued Expenses | 2200 | $15,000 |

Equity

| Equity | Account | Value |

|---|---|---|

| Owner's Capital | 3000 | $200,000 |

| Retained Earnings | 3100 | $50,000 |

| Dividends | 3200 | $20,000 |

Total Assets | $680,000 | Total Liabilities | $335,000 | Total Equity | $270,000 |

Steps to Create a Balance Sheet Template in Excel

- Open a new Excel spreadsheet and create a table with the following columns: Account, Asset/Liability/Equity, and Value.

- List all your assets, liabilities, and equity items in the table, using the above template as a guide.

- Assign account numbers to each item, starting from 1000 for assets, 2000 for liabilities, and 3000 for equity.

- Enter the values for each item, using formulas to calculate totals and subtotals as needed.

- Use Excel formulas to calculate the total assets, total liabilities, and total equity.

- Use Excel's formatting options to make the template easy to read and understand.

Tips and Variations

- Use separate sheets for different rental properties or investments.

- Include a Notes section to provide additional context for each item.

- Use Excel's built-in functions, such as SUMIFS and VLOOKUP, to automate calculations and data retrieval.

- Consider adding a Cash Flow Statement and Income Statement to create a comprehensive financial reporting package.

By using this balance sheet template in Excel, you can effectively manage your rental property finances, make informed decisions, and ensure long-term success.

[Insert Image: Rental Property Balance Sheet Template in Excel]

Gallery of Rental Property Balance Sheet Templates

FAQ

What is a balance sheet, and why is it important for rental properties?

+A balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. For rental properties, a balance sheet is essential to track assets, manage liabilities, and monitor equity.

What are the main components of a balance sheet?

+A balance sheet consists of three main sections: assets, liabilities, and equity.

How do I create a balance sheet template in Excel?

+Use the provided template as a guide, and follow the steps outlined in the article to create a balance sheet template in Excel.

We hope this article has provided you with a comprehensive understanding of the importance of a balance sheet for rental properties and how to create a template in Excel. By following these steps and using the provided template, you can effectively manage your rental property finances and make informed decisions.